In the little time that cryptocurrencies have existed, many new concepts and procedures have been brought to us, such as decentralization, coins, tokens, altcoins, etc. The Initial Coin Offering, or ICO, is one such procedure that has been made possible by the cryptocurrency revolution.

An initial coin offering (ICO) is a crowdfunding technique used by companies offering decentralized goods and services and running on an irreversible distributed ledger. To finance the project’s development, digital currencies or tokens must be created and sold.

IPOs are another procedure in the crypto industry. An investor receives stocks or shares in return for their investment during an IPO. A private firm can expand and become public by initiating the Initial Public Offering (IPO), a well-defined and documented procedure. Throughout the procedure, there are some formalities. The term “IPO” refers to a company’s shares being sold to the general public with the intention of raising money for development.

Although these pathways denote different ways for businesses to acquire capital, they have quite different internal workings, benefits, and possible drawbacks. In this blog, we will discuss an extensive comparison of Initial Coin Offering vs Initial Public Offering with an emphasis on the important differences to help you make informed investing choices.

What is ICO and How Does it Work?

Let’s get to know what is ICO and how does it work. An Initial Coin Offering (ICO) is a fundraising mechanism primarily used by startups and companies in the cryptocurrency and blockchain space. It allows these entities to raise capital by offering digital tokens or coins to investors, typically in exchange for established cryptocurrencies like Bitcoin or Ethereum, or sometimes fiat currency.

An ICO is similar to an Initial Public Offering (IPO) in the stock market, but instead of offering shares in a company, an ICO offers digital tokens. These tokens may represent various things, such as a stake in a blockchain project, a right to use a particular service or access to a decentralized application.

The process of an ICO generally involves the following steps:

1. Announcement and Whitepaper: The company or project team announces the ICO and releases a whitepaper. This document outlines the project’s goals, technology, business plan, team, and how the funds will be used. It also details the technical specifications of the token being offered.

2. Pre-ICO Stage: Pre-ICO stages are held by some ventures in order to generate early capital and publicity. This phase often offers tokens at a discounted rate to early investors.

3. Token Sale: During the main ICO event, tokens are offered to investors. The sale can last from a few days to several weeks. Investors participate by sending their funds (usually in cryptocurrencies) to a designated address provided by the ICO organizers.

4. Token Distribution: Once the ICO concludes, the tokens are distributed to the investors’ wallets. These tokens can be used within the project’s ecosystem or traded on cryptocurrency exchanges if they gain listing approval.

5. Post-ICO Development: The raised funds are used to develop the project as per the roadmap. Successful projects often see their tokens appreciated in value if they deliver on their promises and achieve significant milestones.

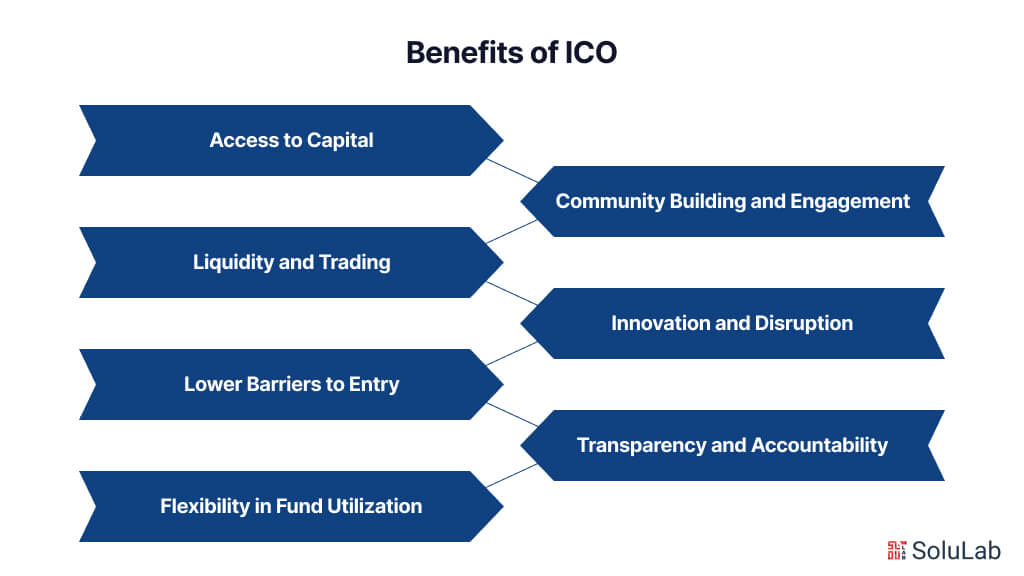

Benefits of ICO

Initial Coin Offerings (ICOs) have gained popularity as a novel fundraising mechanism in the digital age, particularly within the cryptocurrency and blockchain industries. Here are some of the key benefits of ICOs:

1. Access to Capital

- Global Reach: ICOs provide startups and emerging projects access to a global pool of investors. Traditional fundraising methods are often limited by geographical and regulatory barriers, but ICOs leverage the borderless nature of cryptocurrencies to attract investments from around the world.

- Ease of Fundraising: The process of launching an ICO can be simpler and faster compared to conventional methods like venture capital or bank loans. With the right team and a compelling whitepaper, projects can raise significant amounts of capital in a relatively short period.

2. Community Building and Engagement

- Early Community Involvement: ICOs help in building a strong community of supporters and users right from the start. Investors who participate in an ICO often become advocates for the project, contributing to its promotion and adoption.

- Incentivized Participation: By offering tokens, projects incentivize early adopters and investors to participate in the ecosystem. These tokens can grant holders various rights within the platform, such as governance, access to services, or profit-sharing.

3. Liquidity and Trading

- Tradable Tokens: Unlike traditional equity, which might be locked up for extended periods, tokens from an ICO can often be traded on cryptocurrency exchanges soon after the ICO concludes. Investors can use this liquidity for trading or for selling their tokens on secondary marketplaces.

- Market-Driven Valuation: The value of tokens can fluctuate based on market demand and the project’s performance, providing opportunities for investors to realize gains if the project succeeds and gains traction.

4. Innovation and Disruption

- Encourages Innovation: ICOs have enabled a wave of innovation in the blockchain and cryptocurrency space. By providing a new avenue for fundraising, ICOs empower startups to pursue ambitious projects that might not have received funding through traditional means.

- Disruptive Potential: Through democratizing the availability of investment possibilities, initial coin offerings (ICOs) have the potential to upend established financial systems. This decentralization can lead to more diverse and inclusive funding environments.

5. Lower Barriers to Entry

- Reduced Financial Intermediaries: ICOs eliminate the need for many financial intermediaries, such as investment banks and brokers. The fundraising process may be made more efficient and less expensive by cutting out intermediaries.

- Accessibility for Small Investors: Traditional investment opportunities often require significant capital, which can exclude small investors. ICOs, on the other hand, typically allow participation with relatively small amounts of cryptocurrency, making it accessible to a broader audience.

6. Transparency and Accountability

- Transparent Process: The use of blockchain technology ensures that all transactions related to the ICO are recorded on a public ledger. This transparency can increase trust among investors, as they can verify the allocation and use of funds.

- Smart Contracts: Many ICOs utilize smart contracts to automate and enforce the terms of the token sale. This can include aspects like fund distribution, token issuance, and governance, enhancing accountability and reducing the risk of fraud.

7. Flexibility in Fund Utilization

- Flexible Funding Structures: ICOs allow projects to structure their fundraising in various ways. This could include setting hard and soft caps, conducting multiple funding rounds, or even having continuous token sales.

- Funds for Development: The capital raised through an ICO can be used directly for project development, marketing, and operational costs, enabling startups to focus on growth and innovation.

Risks Associated with ICO

While Initial Coin Offerings (ICOs) offer numerous benefits, they also come with significant risks that potential investors and project creators should carefully consider. Here are the primary risks associated with ICOs:

1. Regulatory Uncertainty

- Lack of Clear Regulations: The legal status of ICOs varies widely across different jurisdictions. Some countries have clear regulations, while others have yet to establish a legal framework. This uncertainty can lead to sudden changes in the regulatory environment, potentially impacting the viability and legality of a project.

- Risk of Regulatory Action: Governments and regulatory bodies may impose restrictions, fines, or even bans on ICO activities. This can result in the suspension of a project, loss of investor funds, or legal repercussions for the project team.

2. Fraud and Scams

- Prevalence of Scams: The ICO space has seen numerous fraudulent schemes where unscrupulous individuals or groups launch fake projects with no intention of delivering a product or service. Investors may suffer large financial losses as a result of these methods.

- Lack of Accountability: In many cases, the anonymity of the blockchain and the global nature of ICOs make it challenging to hold scammers accountable. Investors may find it difficult to recover their funds or pursue legal action against fraudulent actors.

3. Market Volatility

- Price Fluctuations: The value of tokens issued through an ICO can be highly volatile. Market conditions, investor sentiment, and project developments can cause significant price swings, leading to potential losses for investors.

- Speculative Nature: Many ICOs attract speculative investors looking for quick gains. This speculation can lead to artificial price inflation during the ICO and subsequent sharp declines once the tokens start trading on exchanges.

4. Technical Risks

- Smart Contract Vulnerabilities: ICOs often rely on smart contracts to automate various processes, including token issuance and fund distribution. However, smart contracts are not immune to bugs or vulnerabilities. Exploits can result in loss of funds or other unintended consequences.

- Technical Failures: The underlying technology of an ICO project may encounter technical failures, delays, or scalability issues. Such problems can hinder the project’s progress and affect the value of the tokens.

5. Project Risks

- Team Competence: The success of an ICO largely depends on the competence and reliability of the project team. If the team lacks the necessary skills, experience, or commitment, the project may fail to deliver on its promises.

- Unproven Business Models: Many ICO projects are based on innovative but untested business models. There is a risk that the project may not achieve market adoption, fail to generate revenue, or become obsolete due to technological advancements.

6. Security Risks

- Cyber Attacks: ICOs are prime targets for cyber attacks, including hacking, phishing, and distributed denial-of-service (DDoS) attacks. These attacks can compromise the security of the project, leading to loss of funds and data breaches.

- Wallet Vulnerabilities: Investors must use secure wallets to store their tokens. Vulnerabilities in wallet software or poor security practices can result in the loss of tokens through hacking or theft.

7. Liquidity Risks

- Low Liquidity: Not all tokens issued through ICOs get listed on major cryptocurrency exchanges. Even if listed, some tokens may suffer from low trading volumes, making it difficult for investors to buy or sell significant amounts without impacting the market price.

- Exit Scams: Some projects may perform well initially but later engage in “exit scams,” where the project creators abandon the project and disappear with the remaining funds, leaving investors with worthless tokens.

8. Legal and Compliance Risks

- Intellectual Property Issues: Projects might face legal challenges related to intellectual property, such as patent infringement or trademark disputes. These legal battles can drain resources and hinder project progress.

- Compliance with Securities Laws: Depending on the jurisdiction, tokens issued in an ICO may be classified as securities. Failure to comply with securities laws can result in legal action against the project and its founders and potential financial penalties.

While an ICO platform presents exciting opportunities, they are fraught with risks that can lead to significant financial losses and legal challenges. Investors and project creators must perform thorough due diligence, and assess the risks to solve the complexities of the ICO ecosystem safely.

Now, we shall discuss the IPO meaning or Initial Public Offering in more details.

What is an Initial Public Offering?

An initial public offering (IPO) is the procedure by which a private firm first makes its shares available to the general public. This event transforms the company from a privately held entity into a publicly traded one, allowing it to raise capital from public investors.

How Does an IPO Work?

An Initial Public Offering (IPO) is a complex process that involves a company offering its stocks to the public for the first time. This process of initial public offering stocks includes selecting underwriters, conducting due diligence, obtaining regulatory approval, marketing the offering, setting the IPO price, and finally listing the stocks on a public exchange. Here is a detailed breakdown of how an IPO works:

1. Preparation and Planning

- Selection of Underwriters: The company selects investment banks, known as underwriters, to manage the IPO process. These underwriters play a crucial role in setting the IPO price, buying the shares from the company, and selling them to the public.

- Due Diligence and Documentation: The company and its underwriters conduct thorough due diligence to ensure all financial statements and business information are accurate and compliant with regulatory standards. This phase involves preparing key documents like the registration statement and the prospectus.

2. Regulatory Approval

- Filing with Regulatory Bodies: In the United States, the company must file a registration statement with the Securities and Exchange Commission (SEC). This document provides detailed information about the company’s financial performance, business model, risks, and management.

- SEC Review: The SEC reviews the registration statement to ensure it complies with legal and regulatory requirements. The company may need to respond to SEC comments and make necessary revisions.

3. Marketing and Roadshow

- Investor Roadshow: The company and its underwriters conduct a roadshow, presenting the business to potential investors across different locations. This marketing effort aims to generate interest and demand for the shares.

- Book Building: During the roadshow, underwriters collect non-binding indications of interest from institutional investors, helping to gauge the appropriate IPO price and demand.

4. Pricing and Allocation

- Setting the IPO Price: Based on investor feedback and market conditions, the underwriters and the company determine the final IPO price. This price is typically set just before the shares are issued.

- Allocating Shares: Shares are allocated to institutional and retail investors. Institutional investors, such as mutual funds and pension funds, often receive a significant portion of the shares due to their large investment capacity.

5. Going Public

- Listing on the Exchange: On the IPO day, the company’s shares are listed on a public stock exchange, and trading begins. The performance of the shares on the first day of trading can vary widely, depending on market sentiment and investor interest.

Benefits of IPO

An Initial Public Offering (IPO) marks a significant milestone for a company, transforming it from a private entity to a publicly traded one. This process offers a range of benefits, providing both immediate and long-term advantages. Here are some of the key benefits of Initial Public Offerings:

1. Access to Capital

- Increased Funding: One of the primary advantages of an IPO is the ability to raise substantial capital by selling shares to the public. This influx of funds can be used for various purposes such as expanding operations, investing in research and development, and paying off existing debt.

- Diversified Investor Base: By going public, companies can attract a diverse group of investors, including institutional investors, retail investors, and mutual funds. This diversified investor base can provide more stability and financial backing for future growth.

2. Enhanced Public Profile and Credibility

- Increased Visibility: Listing on a public stock exchange significantly raises the company’s profile. The media coverage and analyst attention that accompany an IPO can increase brand recognition and market presence, attracting customers and business partners.

- Credibility and Trust: Being a publicly traded company often enhances credibility with customers, suppliers, and potential investors. The rigorous regulatory and financial scrutiny that comes with an IPO reassures stakeholders of the company’s transparency and reliability.

3. Liquidity for Shareholders

- Market Liquidity: An IPO provides liquidity for existing shareholders, such as founders, early employees, and private investors. These stakeholders can sell their shares on the open market, realizing returns on their initial investments.

- Employee Incentives: Publicly traded shares can be used as part of employee compensation packages, such as stock options or equity grants. This can be a powerful tool for attracting and retaining top talent by aligning employee interests with the company’s success.

4. Growth and Expansion Opportunities

- Acquisition Currency: Publicly traded shares can be used as currency for acquisitions, allowing the company to grow inorganically by purchasing other businesses. This strategy can be particularly effective for entering new markets or acquiring new technologies.

- Leverage for Future Financing: A successful IPO can make it easier for a company to secure additional financing in the future. Public companies often have better access to capital markets and can issue additional shares or debt at more favorable terms.

5. Market Valuation and Benchmarking

- Market Valuation: An IPO provides a market-driven valuation of the company. This can help in setting benchmarks for performance and in comparing with competitors in the same industry.

- Stock-Based Compensation: The ability to offer stock-based compensation can align the interests of management and employees with those of shareholders, incentivizing them to work towards enhancing shareholder value.

Risks Associated with IPO

While Initial Public Offerings (IPOs) offer significant benefits, they also come with a range of risks that companies and investors must carefully consider. Understanding these IPO risks is crucial for making informed decisions about participating in or conducting an IPO. Here are some of the key risks associated with IPOs:

1. Regulatory and Compliance Risks

- Regulatory Scrutiny: Going public subjects a company to intense regulatory scrutiny. Compliance with the rules and regulations of securities commissions, such as the SEC in the United States, requires ongoing disclosure of financial and operational information. This can be costly and time-consuming.

- Legal Risks: Public companies are more susceptible to legal actions, including shareholder lawsuits and regulatory investigations. The increased visibility and higher standards of accountability can lead to more frequent legal challenges.

2. Market Risks

- Market Volatility: The stock market can be highly volatile. The price of a company’s shares can fluctuate significantly due to market conditions, economic factors, and investor sentiment. This volatility can impact the company’s market valuation and make it challenging to maintain a stable stock price.

- Underperformance: There is a risk that the company’s shares may underperform post-IPO. If the market perceives that the company has not met its growth expectations or if there are broader market downturns, the stock price can decline, leading to potential financial losses for investors.

3. Financial and Operational Risks

- High Costs: The IPO process is expensive. Costs include underwriting fees, legal and accounting expenses, and the ongoing costs of compliance and reporting. These expenses can be a significant financial burden, especially for smaller companies.

- Short-Term Focus: Public companies often face pressure to meet quarterly earnings expectations. This can lead to short-term decision-making that prioritizes immediate financial performance over long-term strategic goals, potentially harming the company’s overall health and growth.

4. Dilution of Ownership

- Ownership Dilution: Issuing new shares to the public dilutes the ownership percentage of existing shareholders. Founders and early investors may lose some control over the company, which can lead to changes in the strategic direction that may not align with their original vision.

- Potential Loss of Control: With public ownership comes the possibility of hostile takeovers or significant influence from large institutional investors. This can lead to a shift in control and management, which may not always be in the best interest of the original founders or management team.

5. Increased Transparency and Disclosure

- Mandatory Disclosures: Public companies must regularly disclose detailed financial and operational information, including quarterly earnings, executive compensation, and strategic plans. This transparency can be beneficial but also exposes the company to greater scrutiny and competitive disadvantage.

- Loss of Privacy: The requirement for transparency can lead to a loss of privacy regarding company operations and strategies. Competitors can gain insights into the company’s business plans and financial health, potentially using this information to their advantage.

6. Investor Relations and Market Perception

- Managing Investor Expectations: Public companies must manage relationships with a diverse group of shareholders, including institutional and retail investors. Meeting the expectations of these stakeholders can be challenging and time-consuming.

- Reputation Risk: Negative news or perceptions can quickly impact the company’s stock price and reputation. Public companies are more vulnerable to media scrutiny and market rumors, which can affect investor confidence and company valuation.

Difference Between ICO and IPO

Both initial public offerings (IPOs) and initial coin offerings (ICOs) are profitable ways for recently founded businesses to raise capital when the public contributes money in return for anything. But what the investor gets in return for money is one of the biggest distinctions between the two. Accredited investors have the right to voting power over the firm and equity (a company’s assets less its liabilities) in the event of an initial public offering (IPO). During an initial coin offering (ICO), a regular investor will be able to claim ownership and use of the token that is created, but they will not be able to vote or possess any shares in the underlying firm. Here are a few significant differences between IPO vs ICO.

1. Stage

Usually, an ICO takes place fairly early on in the life of the business or initiative. It frequently needs working cash before it has any functioning goods or services in order to develop an untested concept or idea. Because of this, ICOs should expect a higher return on investment than IPOs because they are riskier. IPOs, on the other hand, take place later in a company’s growth. They frequently already have a working product that is profitable and just needs long-term funding and development instead of working capital.

2. Regulation

Regulation is another significant distinction between an IPO and an ICO. Whereas initial public offerings (IPOs) are heavily controlled by government regulatory bodies like the Securities and Exchange Commission, initial coin offerings (ICOs) are primarily self-regulated through smart contracts on the blockchain. Thus, investing in IPOs as opposed to ICOs is often safer. IPO scams have, nonetheless, occurred in the past. Regulatory compliance does not guarantee investor safety; as a stakeholder, you should exercise vigilance and conduct thorough research.

3. Conditions for Listing

An initial coin offering (ICO) can start even if the underlying cryptocurrency isn’t listed on any exchanges. It means that although investors can participate in an initial coin offering (ICO), they will not be able to sell their tokens if they are not listed on any exchange. IPOs, however, are required to have their shares listed on an exchange prior to the offering. This guarantees the two will work together and provides comfort to the investor.

4. Recipients (Intermediaries)

By eliminating the need for intermediaries (exchanges, brokerages, underwriters, regulators, etc.), ICOs have been able to run significantly more effectively than IPOs. An ICO may therefore be significantly more profitable, which is advantageous to both the company or project holding the ICO and the investor. In contrast, IPOs have to pay up to 4% to brokers and other fees to the intermediaries involved.

5. Distribution

The distribution of money is one area where a lot of initial coin offerings have fallen short of initial public offerings. Because “whales” purchase the majority of the coins, for example, certain initial coin offerings (ICOs) distribute their cryptocurrency tokens unfairly and enable market manipulation. IPOs, on the other hand, distribute their shares using a variety of workable strategies that have regulatory approval and guarantee an equitable distribution of asset shares.

6. Category of Investors

Investors who wish to take part in an IPO must adhere to and fulfill the stringent guidelines set out by brokers and authorities. This entails abiding by the rules for AML (anti-money laundering) and KYC (know your customer). However, a lot of initial coin offerings (ICOs) have no prerequisites, so anybody with an internet connection may take part. Recent ICOs do appear to be altering this, though, and upcoming legislation is driving these demands.

Conclusion

In summary, while both Initial Coin Offerings (ICOs) and Initial Public Offerings (IPOs) serve as fundraising mechanisms, they cater to different markets and come with their own unique sets of advantages and disadvantages. ICOs are innovative and accessible, leveraging blockchain technology to democratize access to capital. However, they often face regulatory uncertainty and higher risks of fraud. On the other hand, IPOs provide established regulatory oversight and access to significant capital but involve extensive regulatory compliance and substantial costs. Understanding these differences is crucial for companies and investors to choose the right path for their funding needs.

Both ICOs and IPOs present challenges that require careful navigation. ICOs face issues such as regulatory scrutiny, security vulnerabilities, and market volatility, while IPOs deal with high costs, regulatory burdens, and the pressure of market performance. Future trends in ICOs and IPOs suggest an evolving landscape with increasing regulatory clarity and technological advancements. SoluLab can help you solve these complexities with our expertise in ICO technology and financial regulations. Whether you’re considering an ICO or an IPO, we offer comprehensive support to ensure a successful fundraising journey. Contact us to learn more about how we can assist you in achieving your funding goals.

FAQs

1. What is the primary difference between an ICO and an IPO?

The primary difference between an Initial Coin Offering (ICO) and an Initial Public Offering (IPO) lies in the type of asset being offered and the regulatory environment. An ICO involves selling digital tokens or coins, often used within a blockchain-based platform or project, while an IPO involves selling shares of a company to the public on a stock exchange. ICOs are typically less regulated and accessible globally, whereas IPOs are heavily regulated by financial authorities.

2. What are the main advantages of an ICO?

The main advantages of an ICO include lower barriers to entry, global accessibility, and a faster, more streamlined fundraising process. ICOs leverage blockchain technology, which allows startups to reach a broad audience of investors without the need for intermediaries like investment banks. This can make ICOs a more cost-effective option compared to traditional fundraising methods like IPOs.

3. What are the risks associated with participating in an ICO?

Risks associated with participating in an ICO include regulatory uncertainty, potential for fraud and scams, market volatility, and technical vulnerabilities such as smart contract bugs. Investors should conduct thorough due diligence and be aware that the lack of regulation can sometimes lead to higher chances of fraudulent activities.

4. How do regulatory requirements differ between ICOs and IPOs?

ICOs typically operate in a more loosely regulated environment, though this is changing as governments worldwide introduce new regulations to protect investors. IPOs, on the other hand, are highly regulated and require companies to comply with extensive disclosure and reporting requirements set by financial authorities like the SEC in the United States. This regulatory framework provides greater transparency and investor protection in IPOs compared to ICOs.

5. How can SoluLab help with launching an ICO or an IPO?

SoluLab offers comprehensive support for both ICOs and IPOs, helping businesses navigate the complexities of fundraising. For ICOs, SoluLab provides expertise in blockchain technology, smart contract development, and regulatory compliance. For IPOs, we assist with preparing the necessary documentation, ensuring compliance with regulatory requirements, and managing the entire process from planning to execution.