As blockchain technology advances, a concept that stands prominently for its innovative potential is Real-World Asset Tokenization. During a recent webinar organized by Genfinity, executives from InvestaX, Plug and Play, and the XDC Network convened to examine the problems and possibilities influencing the RWA sector. With around 90,000 attendees engaged, the event highlighted the increasing interest in the anticipated $30 trillion tokenization industry and its impact on transforming financial markets.

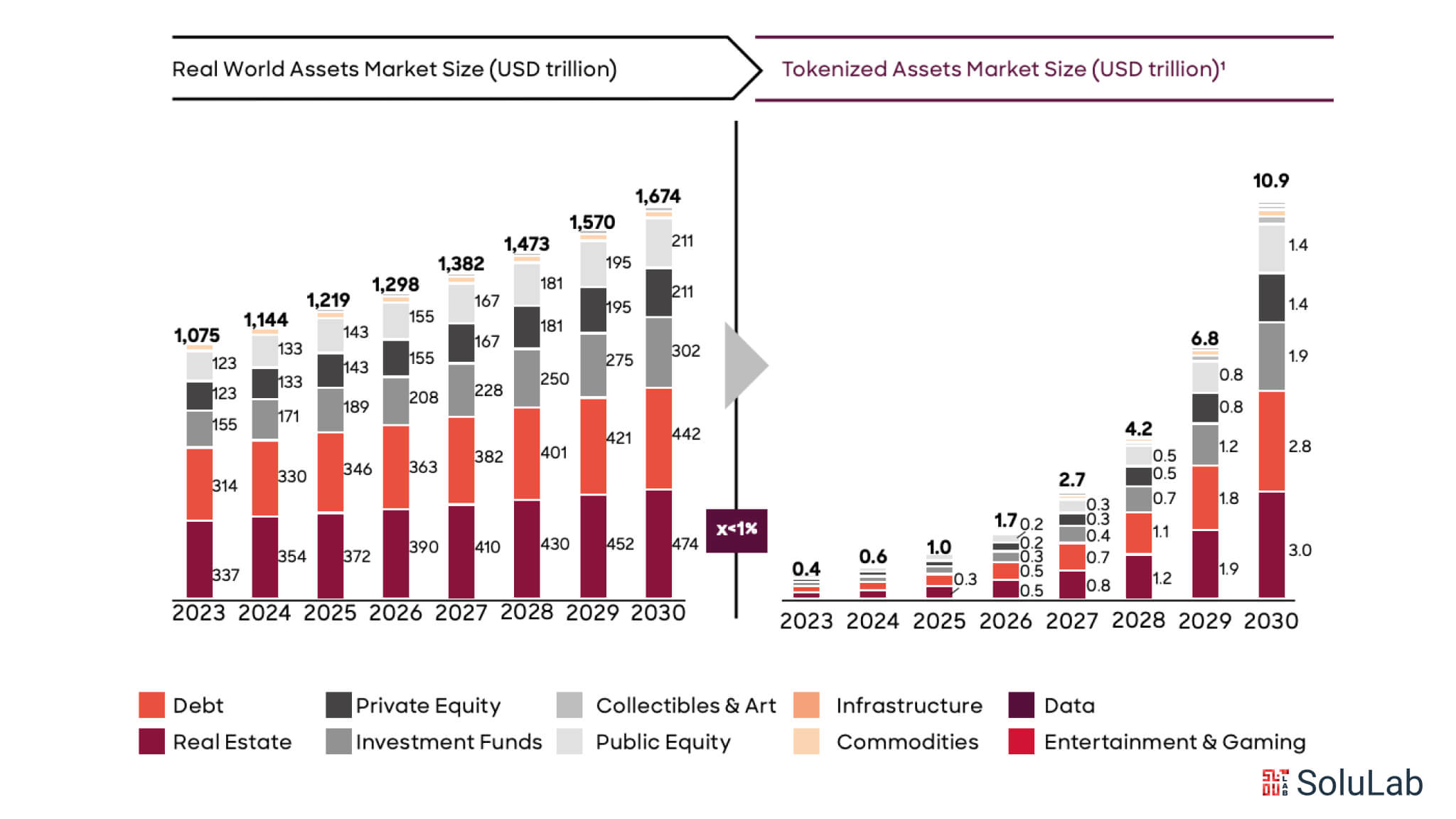

Real-world asset (RWA) tokenization refers to converting tangible assets such as currency, financial instruments, real estate, or commodities into digital tokens on a blockchain, facilitating more cost-effective, expedited, and accessible asset transactions. Roland Berger forecasts that the value of tokenized assets will surpass $10.9 trillion by 2030, with real estate, debt, and investment funds identified as the three predominant kinds of tokenized assets.

In this blog, we will look at the transformation of the investing environment through the tokenization of real-world assets, enhancing liquidity, automation, and worldwide accessibility for both investors and asset owners.

Overview of Real-World Asset Tokenization

Real-World Asset (RWA) denote tangible and intangible assets of inherent worth in the physical or legal environment. These may include real estate, precious metals, intellectual property, and bills. Historically, investing in these assets necessitated substantial cash, extensive documentation, and restricted liquidity.

Nonetheless, the emergence of blockchain technology and real-world asset tokenization services has enabled the digitization, fractionalization, and seamless trading of these assets, hence enhancing their accessibility and efficiency for global investors.

Key Characteristics of RWAs:

Below are a few of the key characteristics of real-world asset tokenization:

-

Tangible Assets

Real-world assets often comprise tangible assets that possess quantifiable worth and can be perceived, handled, or possessed conventionally. This includes real estate assets, precious metals, artwork, automobiles, and infrastructure initiatives. These assets are generally comprehended in conventional finance and function as dependable investment instruments, owing to their tangible existence and consistent worth.

-

Intangible Assets

Not all RWAs are tangible. Intangible assets, like patents, copyrights, trademarks, brand equity, and carbon credits, possess significant value. These are assets that are located in intellectual or legal domains and significantly raise the value of businesses and projects. Real-world asset tokenization services enable the digital representation and trading of intangible assets.

-

Stable Value Base

In contrast to extremely volatile digital assets like cryptocurrency, RWAs possess real-world utility or inherent value. Their prices are often influenced by supply and demand dynamics, legal frameworks, or economic foundations, rendering them more stable and dependable for long-term investment plans.

-

Traditionally Illiquid

RWAs have historically posed challenges for trading due to substantial entry fees, long transaction cycles, and regulatory obstacles. The sale of real estate or intellectual property typically entails intricate legal and administrative procedures. The absence of liquidity has deterred several prospective investors from engaging with such assets.

-

Tokenization Capability

The tokenization of real-world assets enables the division of conventional assets into digital tokens that signify ownership or rights. This facilitates fractional ownership, expedites transactions, enhances transparency, and enables borderless investing. Platforms providing the tokenization of financial assets enable the purchase, sale, or exchange of fractional interests in high-value assets—an opportunity that was previously inconceivable for individual or small-scale investors.

Why is Real-World Asset Tokenization Important?

With just a few hundred dollars, you would be able to make investments in a wind farm in Europe, a Picasso painting, or a luxury hotel in Dubai. That is the power of real-world asset tokenization. It’s not only a jargon it’s a change that’s opening conventional investments more globally, more transparently, and more efficiently. Here’s why real-world asset tokenization is important:

1. Breaking Big Assets into Bite-Sized Investments

Historically, the great cost of assets like real estate or collectibles has limited availability to rich investors. But with tokenized real-world assets, ownership is distributed into smaller digital tokens, which makes investing in high-value assets simple for everybody without requiring a large budget. It’s similar to a smart investment meeting crowdsourcing.

2. Increasing Inclusive Investing Efforts

Many high-value assets were exclusively available to elite individuals or institutions prior to tokenization. Thanks to blockchain, investment is practically accessible to virtually anybody now. You only need a phone and internet; millions to acquire a piece of excellent real estate is no longer necessary. Real-world asset tokenization allows common people to participate in possibilities long beyond reach.

3. Establishing Trust by Transparency

Every item on the blockchain cannot be altered; it is all recorded. That implies that records of ownership, transactions, and even income sharing are all very obvious. Tokenized real-world assets eliminate guessing; investors know exactly what they possess and how it is doing. Smart contracts also streamline the whole process, therefore eliminating intermediaries and reducing human error.

4. Simpler and Faster Process

Traditional asset management may be a headache—tons of documentation, cumbersome procedures, and constant back-and-forths. All of that becomes simplified, though, when you deal with a real-world asset tokenization development business. Transfers take minutes, ownership is shown right away, and maintaining assets is easier than it has been in years.

5. Opening Doors to New Financial Tools

Tokenization stimulates creativity as well. Consider revenue-sharing tokens, think asset-backed loans, or real estate-based DeFi solutions. These are not only concepts; they are already under development and altering our perspective on money and investment.

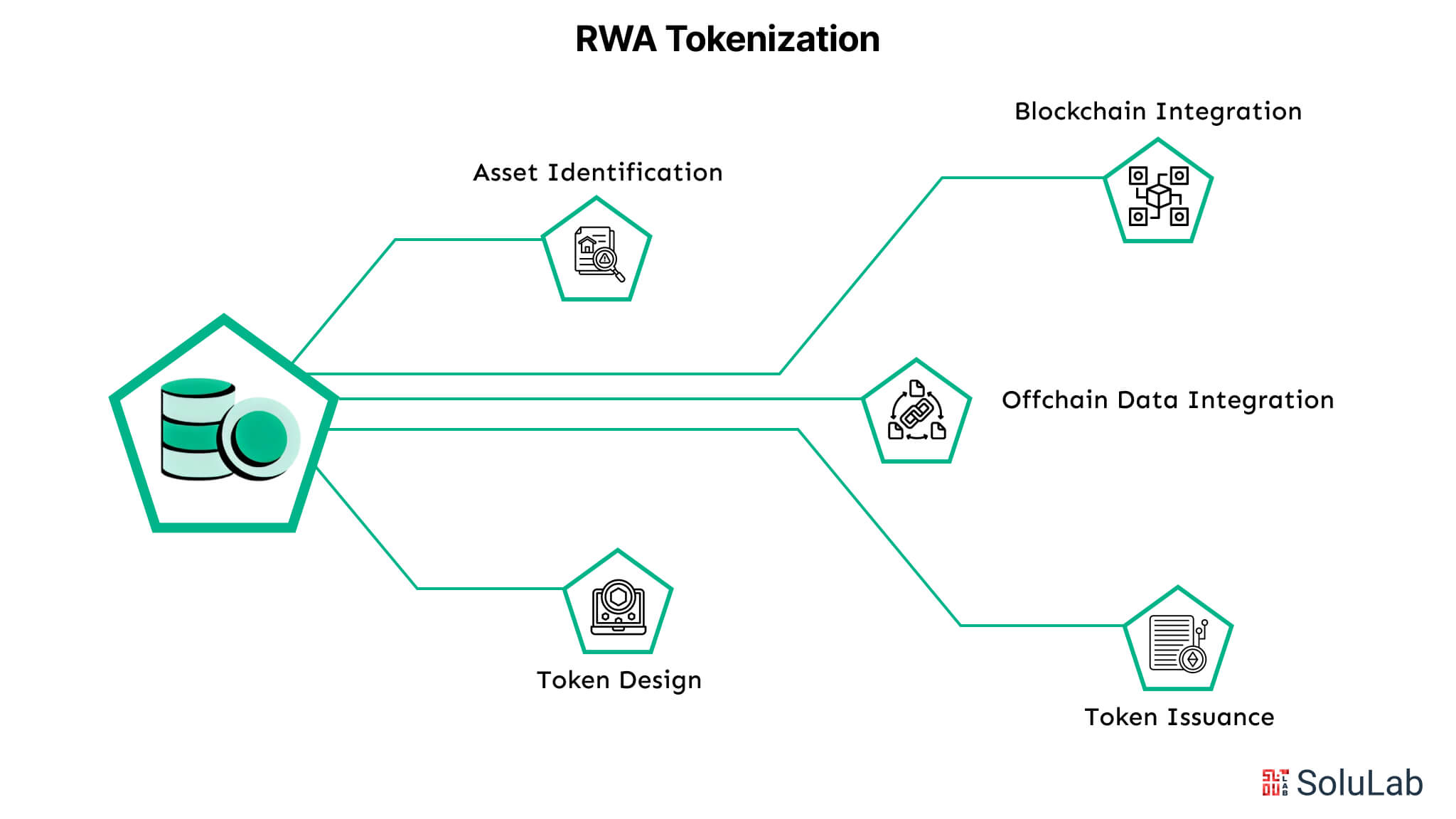

How Does Real-World Asset Tokenization Work?

Real-world asset (RWA) tokenization is blockchain digital tokenization of physical or intangible asset ownership rights. This method generates a blockchain-based asset representation that enables effective, open, safe on-chain control of property rights. This is a fundamental invention that closes the distance between digital finance and the physical world.

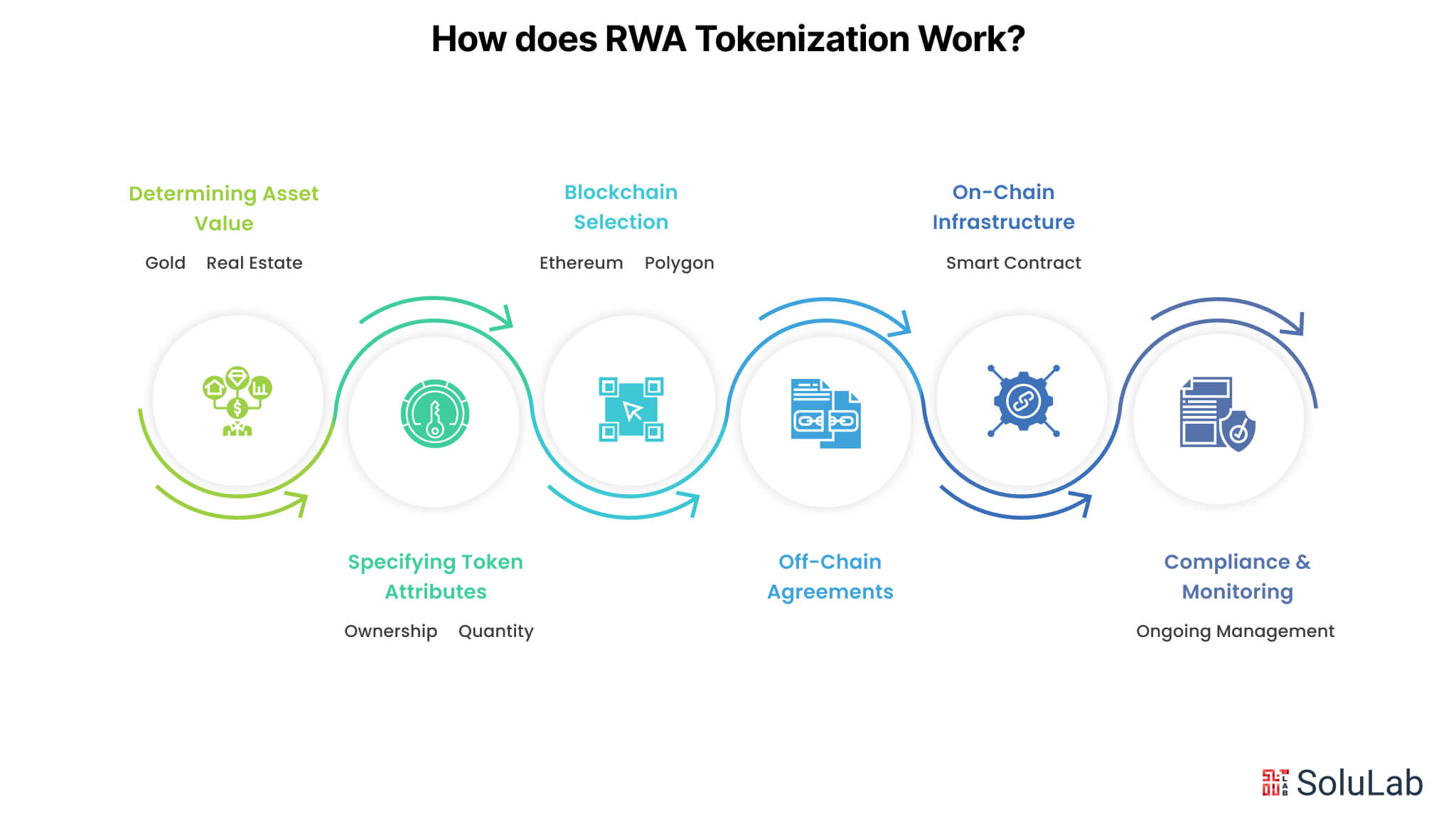

Steps for Tokenizing a Real-World Asset

Here is the step-by-step process of tokenizing real-world assets:

-

Determining the Asset’s Value

Choosing a real-world object fit for tokenization and with value comes first. Common selections are items including real estate, gold, fine art, or even intellectual property assets. At this point, elements like legal clarity, market value, and demand in digital markets.

-

Specifying Token Attributes

Finding out how the token will depict the selected item comes second once it has been selected. Will the token give either partial or whole ownership? Will there be issues? What legal and regulatory criteria does it satisfy? These choices define the behavior and trading pattern of the token in the digital sphere.

-

Blockchain Selection Process

Choosing a suitable blockchain platform is quite vital. It has to be scalable, low transaction cost compatible, secure, and smart contract compatible. Popular alternatives based on the usage case and user base are Ethereum, Polygon, and Solana.

-

Sync Off-Chain Agreements

Legal and operational systems have to be developed before going online. This covers legal paperwork, asset evaluation, and custodial mechanisms to guarantee the token is supported by the real, physical, or legal asset. These off-chain components assist in preserving compliance and reputation.

-

Implementing On-Chain Infrastructure

The real advantages of tokenizing start to become apparent here. Smart contracts help to control asset-related activities, automate transfers, and control ownership. Minted with liquidity, compliance, and governance tools, tokens are built to allow seamless and safe blockchain trade.

-

Compliance and Custodial Monitoring

Following tokenization, the asset calls for continuous management. Whereas regulatory monitoring guarantees compliance, custodial services protect the physical asset. Constantly reviewed are legislative changes, pricing adjustments, and market trends to safeguard asset value as well as investors.

Through real-world asset tokenization—gaining transparency, liquidity, and accessibility—businesses and investors may open fresh opportunities by following this procedure. The benefits of tokenization go much beyond digitalization; it allows easy investment and trade in assets before only accessible to a small group of people.

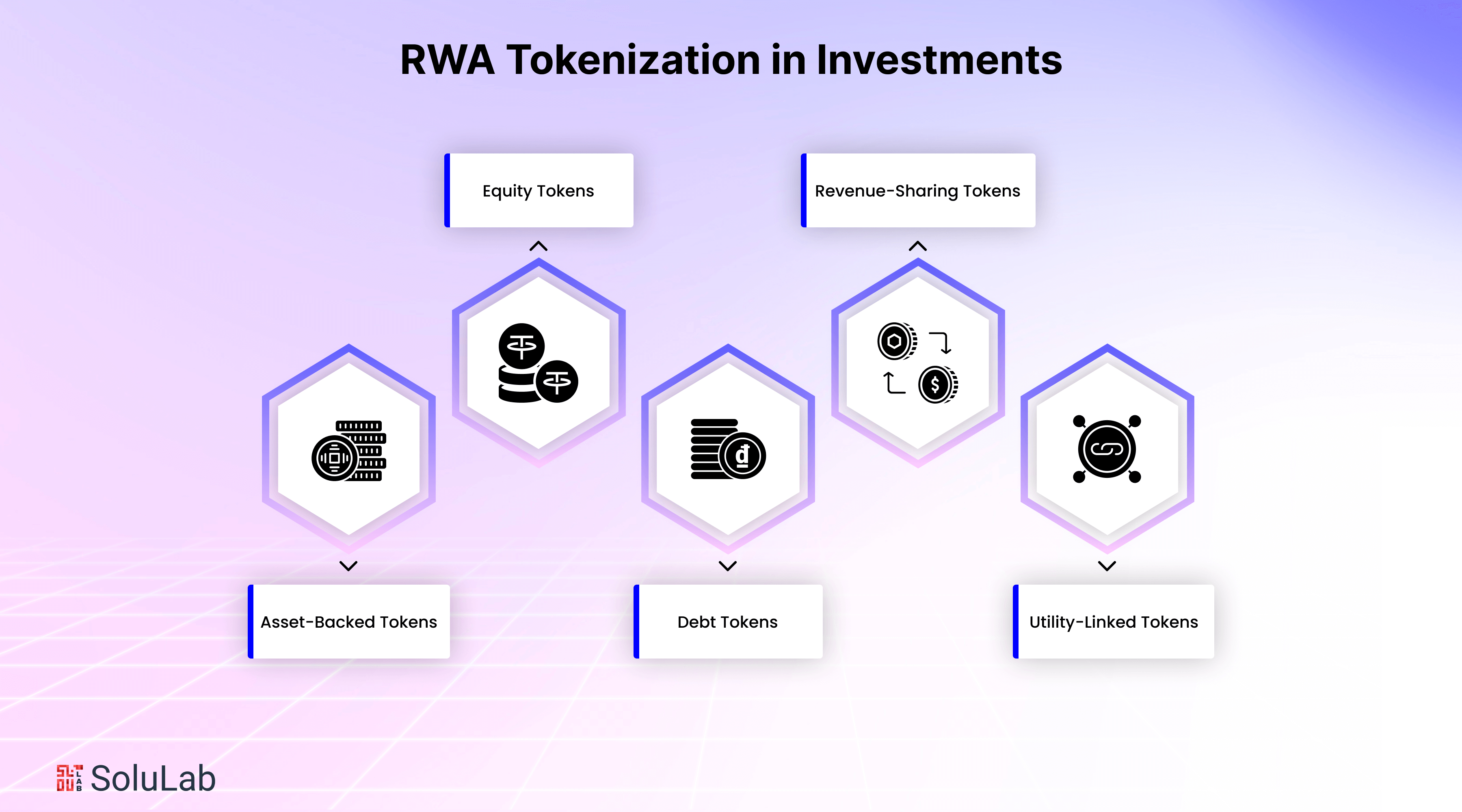

Types of Real-World Asset Tokens

Tokenized assets vary significantly; each fulfills a specific role depending on its representation and functionality within the digital economy. As the tokenization of real-world assets progresses, many token types have arisen to address the varying interests of investors and comply with legal standards. Here are the types of RWA tokens:

1. Asset-Backed Tokens

These tokens are directly associated with physical or tangible assets like as gold, real estate, or commodities. Each token signifies a claim on the tangible asset, often maintained and authenticated by a reliable custodian. This framework guarantees confidence and stability, rendering it suitable for investors pursuing lower-risk exposure to tangible wealth.

2. Equity Tokens

Equity tokens, structured to replicate corporate shares, provide ownership rights, voting privileges, and possible dividends to their holders. They are commonly utilized in startup financing and tokenized business frameworks, providing a blockchain-based substitute for conventional equity markets.

3. Debt Tokens

Debt tokens signify tokenized representations of loans or credit agreements. Investors get interest disbursements and principal reimbursement according to stipulated conditions. These are frequently utilized in real estate debt arrangements, invoice financing, or peer-to-peer lending frameworks.

4. Revenue-Sharing Tokens

Instead of conferring ownership, these tokens allocate to holders a portion of the cash generated, such as rental income, product sales, or service fees. They are a favored option for tokenized real estate and corporate enterprises, wherein investors receive compensation from continuous cash flow.

5. Utility-Linked Real-World Asset Tokens

These tokens provide practical advantages beyond mere investment, such as exclusive access, discounts, or use rights associated with the real-world commodity. A token may grant early booking privileges for a tokenized property or access to electricity generated by a solar installation.

Selecting the appropriate structure for a tokenized real-world asset is reliant upon the investment objective, asset category, and regulatory requirements. Collaborating with a renowned real-world asset tokenization development company makes sure that each token is designed with an optimal balance of security, functionality, and legal precision.

How Does RWA Tokenization Profit SMEs and Startups?

Small and medium-sized firms (SMEs) and startups have long struggled to get funding. Traditional funding options, such as bank loans, venture capital, or equity financing, can have high obstacles, extensive documentation, and lengthy approval delays. This is where real-world asset (RWA) tokenization emerges as a game changer.

By transforming actual or intangible company assets into digital tokens, startups and SMEs may have access to funding more quickly, flexibly, and comprehensively.

Here are some of the benefits of RWA tokenization:

-

Alternative Fundraising Option

SMEs can raise capital without giving up equity or incurring debt. By providing tokenized real-world assets, they can attract retail and institutional investors seeking exposure to new asset-backed possibilities.

-

Providing Fractional Ownership

Tokenization permits fractional ownership, which means that high-value assets may be divided into smaller investment units. This opens the door for micro-investors who were previously barred owing to hefty capital requirements.

-

Faster Liquidity and Cash Flow

Rather than waiting months for loan approvals or fundraising rounds, blockchain-enabled platforms allow firms to tokenized assets and produce liquidity in weeks, if not days.

-

Enhanced Trust and Transparency

The transparency of blockchain ledgers fosters investor confidence. It demonstrates a clear record of ownership, value, and asset performance, which helps firms build trust with stakeholders and early adopters.

-

Global Reach Without Borders

Tokenized offers allow entrepreneurs to sidestep territorial barriers and attract global investors without the need for traditional financial middlemen.

Which Industries Are Being Transformed By Real-World Asset Tokenization?

Tokenization is transforming how we interact with important physical and intellectual assets. Transforming ownership rights into digital tokens has created new possibilities for individuals to invest, trade, and participate in asset value without requiring substantial resources. The following are six kinds of real-world assets undergoing significant transition via tokenization:

1. Real Estate

Real estate has always been perceived as a high-barrier investment because of its substantial expenses and intricate procedures. Tokenization dismantles these obstacles by segmenting properties into smaller digital pieces known as tokens. This enables several investors to possess shares of a singular property, enhancing real estate accessibility for a broader audience and facilitating global engagement in localized markets.

2. Art and Fine Artworks

The art market, hitherto exclusively for affluent collectors, is undergoing democratization via tokenization. Costly artworks can be split into tokens, each signifying fractional ownership. A $1 million painting may be divided into 1,000 tokens, allowing art aficionados and small investors to co-own and derive value from legendary works.

3. Commodities

Valuable resources such as gold, silver, oil, and agricultural products may now be digitally represented and exchanged through tokens. Investors can get tokenized fractions instead of purchasing a whole gold bar or barrel of oil. This not only reduces the investment barrier but also streamlines storage, security, and trade procedures.

4. Equity and Corporate Shares

The tokenization of corporate shares enables people to invest in enterprises with much-reduced capital expenditures. Tokenized equities facilitate fractional ownership, expand investor involvement, and allow for real-time, cost-effective trading, frequently beyond conventional exchanges. It represents a more adaptable and inclusive method for corporate financing and equity participation.

5. Intellectual Property

Creative assets, including music, films, patents, and software, may be tokenized to generate cash and distribute revenue. An artist may tokenize a song and sell tokens that signify a stake in its future earnings. This provides artists with direct access to finance, while fans and supporters may gain from the asset’s economic success.

6. Collectibles and Memorabilia

The market for rare objects, like trading cards, vintage sports equipment, and historical relics, is increasingly becoming transparent and liquid due to tokenization. Digital tokens denoting ownership of these treasures facilitate the processes of purchasing, selling, and authenticating. It further expands these specialty industries to a wider array of collectors and investors.

Business Use Cases for RWA Tokenization

Tokenization is transforming corporate operations by establishing novel frameworks for funding, transparency, and consumer involvement. The increasing adoption of blockchain technology across several sectors is facilitating the digital representation of real-world assets, hence enhancing efficiency, liquidity, and scalability. Businesses are utilizing real-world asset tokenization in several appealing ways. such as:

1. Equipment Leasing and Asset Monetization

Enterprises in construction, shipping, and manufacturing frequently depend on expensive machinery. By tokenizing the financial worth of this equipment, organizations may generate cash by issuing digital tokens secured by anticipated use revenue or rental income. This offers immediate financing while permitting ongoing utilization of the asset.

2. Carbon Credits and Environmental Assets

Organizations involved in sustainability initiatives can digitize carbon credits and other ecological assets, facilitating their tracking, verification, and trading. Tokenization improves transparency in ESG activities and facilitates a more accessible market for the purchase and sale of environmentally sustainable effects.

3. Event Ticketing and Access Control

Concert promoters, sports leagues, and entertainment corporations may issue blockchain-based tickets that are impervious to duplication and scalping. These digital tickets may also encompass additional advantages like as discounts, early access, or loyalty rewards—all embedded within the token for seamless and safe distribution.

4. Agricultural Pre-Sales and Produce Financing

Farmers and agribusinesses can utilize tokenization to get financing before harvest season. Producers may secure funds in advance by providing tokens backed by future harvests or product deliveries, ensuring purchasers are assured delivery at equitable rates. This diminishes reliance on borrowing and stabilizes financial flow.

5. Premium Products and Anti-Counterfeiting Measures

Luxury apparel firms and watch manufacturers may integrate digital tokens into their supply chains to serve as verification of authenticity. Every item sold is associated with a unique, tamper-resistant token, enabling purchasers to authenticate provenance and ownership history, enhancing confidence in both primary and secondary markets.

The Future of Real-World Asset Tokenization

With the rapid acceptance of blockchain technology and the development of legal frameworks, the prospects for real-world asset tokenization appear exceedingly favorable. We are progressing towards a financial system in which various assets—real estate, art, commodities, intellectual property, and future earnings—can be digitized and exchanged continuously on global networks. This transition will not only release billions of dollars in previously illiquid assets but also transform the methods of wealth creation, trade, and storage. Tokenization will obscure the distinctions between traditional and digital finance, providing a more inclusive and efficient investment environment that is advantageous to both asset proprietors and investors.

In the years ahead, we expect a more profound integration of tokenized assets with decentralized finance (DeFi), facilitating the lending, borrowing, and staking of real-world assets. Institutional participants are already joining the sector, which will likely expedite mainstream acceptance and stimulate innovation in token standards, compliance, and custodial solutions. Enhanced interoperability among blockchains and the emergence of more user-friendly platforms position real-world asset tokenization as a fundamental component of the global economy, facilitating safe, borderless, and transparent ownership of virtually any valuable item.

The Bottom Line

Tokenization of real-world assets transcends mere trends; it is a transformational movement that redefines investment, trading, and the realization of value from both physical and intangible assets. Tokenization fosters a more inclusive and efficient financial ecosystem for all participants by facilitating fractional ownership, enhancing liquidity, and eliminating conventional investing obstacles.

SoluLab specializes in assisting organizations in adopting this shift via customized, secure, and compliant tokenization solutions. As a top asset tokenization company, we have recently collaborated with Borrowland, a cryptocurrency borrowing and lending platform, to elevate decentralized finance on a worldwide scale. Borrowland, utilizing blockchain technology, enables users to lend, borrow, exchange, and manage cryptocurrency assets effortlessly, transforming the lending paradigm in the digital era.

If you’re ready to explore tokenization for your business or project, SoluLab is here to guide you every step of the way. Reach out today, and let’s build the future of finance together.

FAQs

1. What is real-world asset tokenization?

Real-world asset tokenization refers to the conversion of ownership rights of physical or intangible assets, such as real estate, art, or patents, into digital tokens on a blockchain. These tokens may be exchanged, sold, or retained similarly to other digital assets, providing enhanced liquidity and accessibility.

2. What advantages does tokenization offer to investors?

Tokenization enables investors to possess portions of high-value assets with reduced financial demands. It enhances transparency, diminishes entry barriers, and facilitates access to previously illiquid markets such as real estate or collectibles while also enabling expedited and more secure transactions using blockchain technology.

3. Is the tokenization of real-world assets lawful and subject to regulation?

Affirmative, albeit it is contingent upon the jurisdiction. Global regulatory frameworks for asset tokenization are currently developing. Collaborating with seasoned legal and blockchain professionals is essential to guarantee adherence to security, KYC/AML, and financial rules in your jurisdiction.

4. Can small enterprises and startups derive advantages from asset tokenization?

Indeed. Tokenization enables SMEs and startups to access liquidity by digitizing assets, such as inventories, intellectual property, or anticipated income. This grants access to money without conventional loans or equity dilution, and facilitates entry for global investors.

5. In what ways may SoluLab assist with the tokenization of real-world assets?

SoluLab provides comprehensive development services for real-world asset tokenization, encompassing smart contract development, legal advisory integration, and platform design.