Stablecoins on Solana, are digital currencies, designed to maintain a stable value. Often pegged to fiat currencies like the US dollar. It can built on the high-performance Solana blockchain. These stablecoins combine traditional currencies with the speed and efficiency of decentralized systems. Solana’s unmatched scalability, low transaction costs, and processing make it a desired choice for developers and businesses creating stablecoin solutions.

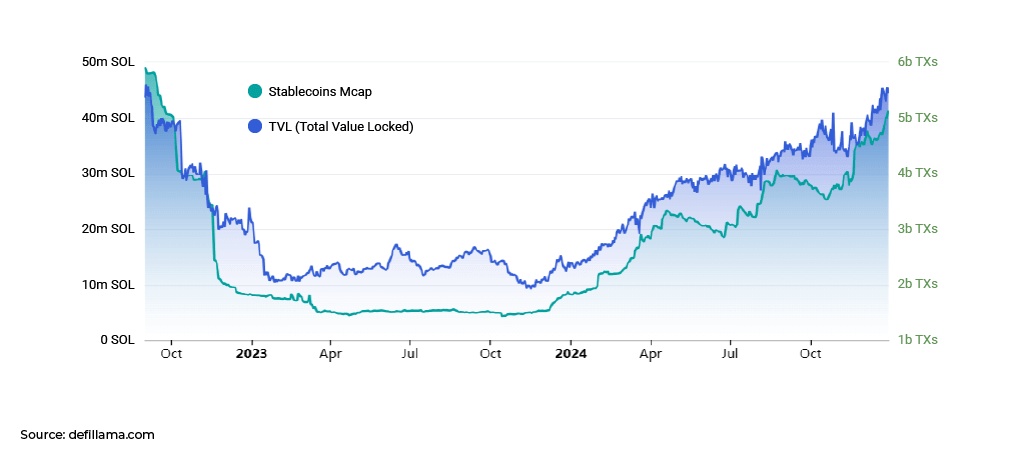

Studies show that the stablecoin market capitalization reached $5.24 billion, the largest amount of the year, surpassing even the September peak. An important sign of the network’s increasing liquidity and growth is due to the global stablecoin ecosystem. At just $1.83 billion at the beginning of the year, Solana’s stablecoin market capitalization has proven an impressive growth pattern.

However, asset-backed stablecoin development is difficult. Are you concerned about stablecoin stability in volatile markets? Or straining to fulfill shifting regulatory requirements that can make or ruin a project? Hackers can threaten digital assets, and you may worry about security.

Solana excels here. Its sophisticated architecture addresses scalability, performance, security, and developer friendliness for stablecoins. To design a stablecoin that stands out in a competitive market, Solana delivers everything you need to reduce transaction latency, protect assets, and enable cross-chain interoperability.

In this blog, we’ll help you understand what stablecoin is, how to create one its advantages, challenges you should know. So, let’s get started!

Stablecoin Development on Solana – An Overview

Understanding Solana’s unique properties helps us know why a stablecoin development service is crucial. Decentralized blockchain platform, Solana optimizes quick, low-cost transactions. Using new resolution techniques and novel design, it can process 65,000 transactions per second. The stability and efficiency of Solana make it a good choice for creating stablecoins that can handle large numbers of transactions.

As compared to Ethereum, Solana handles transactions quicker and more affordable. According to reports, Solana (SOL), a cryptocurrency on the Solana blockchain, increased by almost 12,000% in 2021 and was valued at over $75 billion altogether, making it one of the best cryptocurrencies. By market capitalization, SOL was among the biggest cryptocurrencies in 2024.

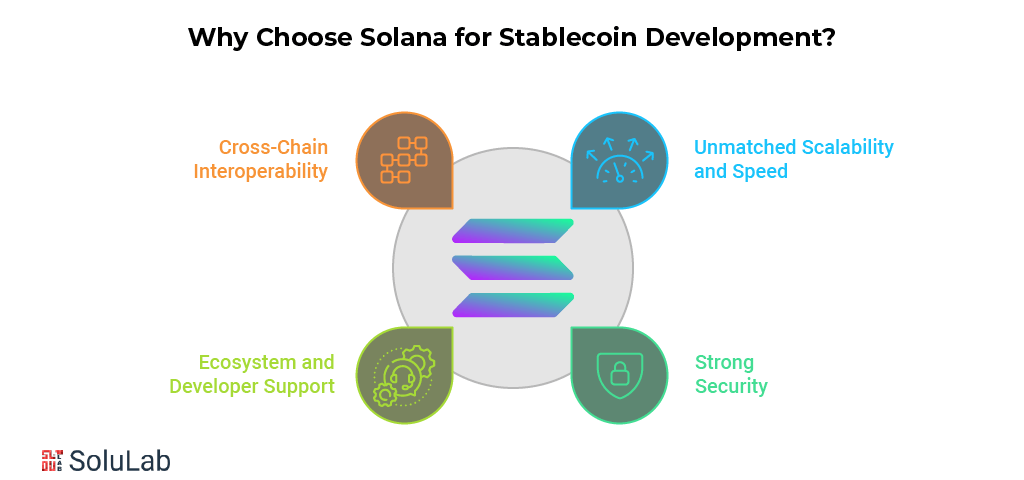

Why Choose Solana for Stablecoin Development?

Stablecoins are designed to handle price volatility, which is a huge plus for users. With this rise in popularity, a range of blockchain platforms have shown their support for stablecoin development. Among them, Solana is the first option.

Stablecoins use cases for Solana are being used by companies, financial institutions (FIs), and people for use cases ranging from international payments to liquidity management, to insurance against currency swings.

So, why should anyone who wants to create stablecoins choose Solana? Let’s break it down:

1. Unmatched Scalability and Speed

Solana is built to handle a massive number of transactions with ease. Its unique design lets it process thousands of transactions per second, making it incredibly fast and scalable. It ensures smooth, stable, and liquid systems for users.

By using Solana’s high throughput, stablecoin platforms can manage growing demand effortlessly, avoid network slowdowns, and deliver lightning-fast transaction confirmations. This combination of speed and scalability makes stablecoins more reliable and boosts user confidence.

Read Also: Build a dApps on Solana

2. Strong Security

One of the primary considerations when developing a stablecoin is security. Solana takes this seriously, protecting user assets and transactions with a high-performance consensus mechanism and sophisticated cryptographic methods.

These Security Token offering measures provide a solid foundation for stablecoin platforms, keeping funds safe and preventing vulnerabilities. For users, this means greater trust in the platform and the entire stablecoin ecosystem.

3. Ecosystem and Developer Support

In addition to being quick and safe, Solana is supported by an expanding ecosystem and community. Solana provides a wealth of resources, tools, and documentation to help developers and service providers execute their jobs more efficiently.

This developer-friendly environment means you can streamline the process of creating and launching stablecoins. The result? Faster development times and a more efficient workflow.

4. Cross-Chain Interoperability

In the blockchain, interoperability is crucial. It’s what allows different platforms to work together and exchange value. Solana recognizes this and supports stablecoin projects that integrate with other blockchains.

By enabling cross-chain interoperability, Solana helps developers access larger liquidity pools and attract a wider user base. This strengthens the stablecoin’s stability and increases its chances of being adopted.

With its unmatched speed, security, ecosystem, and focus on interoperability, Solana ticks all the boxes for stablecoin development. It’s a platform that doesn’t just keep up with the demands of the blockchain world—it sets the standard.

How To Create a Stablecoin on Solana?

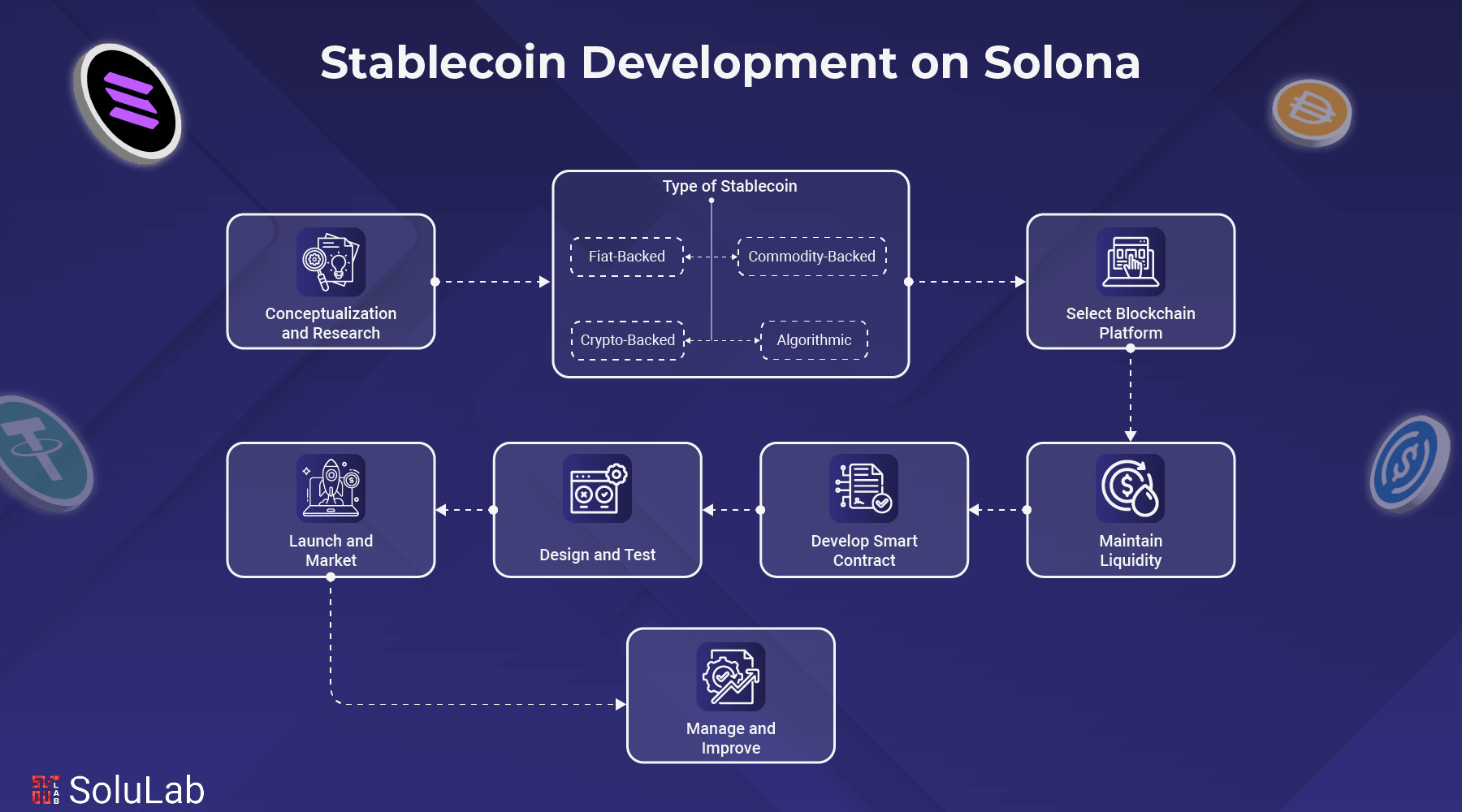

Here are the key steps you should follow to create your stablecoin on Solana:

Step 1 – Conceptualization and Market Research

To create a stablecoin on Solana you should know why you need it. Then next you’ve to clear such things in mind like who it’s for, and how it’s different from the ones already out there. Do market research and watch your competitors. And finally, figure out their weaknesses, and identify how you can do it better.

Step 2 – Choose the Type of Stablecoin

Now, that you have done the market research, and the target audience you’ve selected the right type of stablecoin is a big decision. It’s all about the collateral—whether it’s fiat currency, cryptocurrency, commodities, or algorithms. Each option comes with its benefits and challenges, and this choice will shape the stability, trust, and compliance of your project.

- Fiat-Backed Stablecoins

These are backed by traditional currencies like the US dollar, Euro, or Yen. They’re simple and trustworthy because their value is directly tied to the fiat reserves. - Commodity-Backed Stablecoins

Gold, real estate, or other tangible assets are the backbone here. Examples like Paxos Gold (PAXG) and Tether Gold (xAUT) show how commodities can bring reliability. - Crypto-Backed Stablecoins

These rely on other cryptocurrencies as collateral and use over-collateralization to stay stable. Smart contracts platforms manage the assets, making everything secure and transparent. - Algorithmic Stablecoins

This type uses algorithms like Stablecoins to maintain value. A good example is TerraUSD, which is built on Terra blockchain technology.

Each type serves different needs, so take time to figure out which one aligns with your business goals before diving into development.

Step 3 – Identify the Blockchain Platform

After choosing your preferred type, the next step is choosing a blockchain platform. Ethereum is the go-to for most developers, but platforms like Tron and EOS are also strong contenders. In fact, many startups depend on EOS for its scalability.

Step 4 – Maintenance of Liquidity

While creating stablecoin on Solana liquidity is everything in the stablecoin. Without it, your project won’t work as you want. Focus on strategies like monitoring price changes, managing transaction reserves, and controlling supply as well. These will help keep your stablecoin stable and functional.

Step 5 – Developing a Smart Contract for Stablecoin

Smart contracts are at the core of stablecoin development. They’re digital agreements that guarantee security and transparency. When you hire developers for this, make sure they test everything thoroughly. Testing ensures your blockchain smart contracts are reliable and ready for the decentralized in this competitive market.

Step 6 – Create a Unique Design

Your design isn’t just about looks it’s about functionality. Your stablecoin’s design should make transactions and user interactions personal. At this stage, you’ll map out how everything works and feels for your users.

Step 7 – Testing and Security Audits

If you take this as a service from someone else would you then tolerate any issues in your stablecoin? No one likes bugs or vulnerabilities. Testing and auditing are so important. This step involves a deep knowledge of the blockchain security platform, smart contracts, and how everything integrates with financial systems.

Step 8 – Launch and Marketing

Now you’ve done all the above eight steps and it’s time to go live! Launch your stablecoin on exchanges and financial platforms. But don’t stop there—a strong marketing push is crucial. Let people know why your stablecoin is worth their time and trust.

Step 9 – Continuous Management and Improvements

You’ve made your stablecoin live but the work doesn’t stop after the launch. You’ve to regular updates, collateral monitoring, and compliance with evolving trends. This is how you keep your stablecoin relevant, secure, and trusted.

SoluLab helps businesses create such stablecoins to run their business smoothly. SoluLab has a team of experts to resolve all your business issues. Contact us today.

Advantages of Stablecoins Development on Solana

The latest Solana stablecoin market capitalization highlights very remarkable increase in 2024. At the beginning of the year, the network boasted a stablecoin market cap of $1.83 billion. Stablecoins on Solana offer businesses a combination of speed, security, and scalability, as improve transactions and optimize their financial operations as well.

1. Lower Operating Expenses

Businesses can save transaction-related costs by operating on Solana, where fees are less. These cost savings are significant and can result in higher profitability for businesses that handle large numbers of transactions, whether in remittances, finance, or e-commerce.

2. Global Accessibility

Businesses can reach a worldwide audience using Solana’s stablecoins without being constrained by conventional financial methods. Businesses can use stablecoins to service customers in markets with restricted access to traditional banking by building on a global blockchain, opening up new clientele and revenue streams.

3. Financial Inclusion and Smooth International Trade

Traditional banks charge exorbitant fees and take time to process cross-border payments. Solana-based stablecoins are perfect for companies looking to improve international payments and promote financial inclusion since they enable quick, inexpensive cross-border transactions. Companies may easily grow internationally and make cross-border transactions as easy as domestic ones.

4. Interoperability

Because Solana was designed with connectivity in mind, it can easily link to other blockchain-based networks. A stablecoin’s performance is greatly enhanced by this feature, which allows it to communicate with a variety of dApps and platforms. Solana makes it simpler for AI stablecoins development to interact with other digital services and access larger markets by enabling cross-chain links, which gives users more freedom and utility.

Technical Overview of Stablecoin Development on Solana

The technical overview of stablecoin development on Solana explores the underlying architecture, tools, and features that make the blockchain an ideal platform for building fast, secure, and scalable stablecoin solutions.

1. Connectivity to Solana’s SPL Standard

To generate tokens, the Solana Program Library (SPL) offers a defined set of protocols. Businesses can create stablecoins that work with the Solana ecosystem by utilizing SPL, guaranteeing smooth interaction with wallets, exchanges, and apps that are based on Solana. Businesses may launch their stablecoins more easily and with fewer technical issues because of this interoperability.

2. Flexibility of Smart Contracts

Blockchain smart contracts are so adaptable, that developers can create contracts that are tailored to the unique requirements of various stablecoin types. Businesses can apply the best model for their particular use cases with Solana’s platform’s support for bespoke functions, such as algorithmic stablecoins that change supply or fiat-backed stablecoins that need frequent audits.

3. Improved Security Procedures

Stablecoin development places a high premium on security. To shield assets from hacking and unwanted access, Solana provides several security layers. Solana-based stablecoins are prepared to protect money, reduce risk, and improve company trust by taking a proactive approach to security.

Features of Stablecoin Development on Solana

Customizing stablecoin features allows businesses to tailor digital currencies to their specific needs, enhancing functionality, security, and scalability to support a variety of use cases.

-

Mechanisms for Pegging

Stablecoins could be linked to commodities, fiat money (such as the US dollar), and sometimes other cryptocurrencies. Solana’s flexibility supports a variety of pegging techniques, allowing companies to select the model that best suits their financial plans. Businesses looking for a reliable digital currency that matches the value of tangible assets must have this customization.

-

Governance and Compliance

Businesses must adhere to regulations, particularly in highly regulated sectors. Solana makes it simpler to adhere to local regulations by enabling developers to integrate regulatory safeguards like KYC/AML processes. These characteristics promote a controlled and safe atmosphere, boosting confidence and protecting corporate activities.

-

Transparency and Auditing

Transparency on blockchain is crucial for companies looking to win over investors. Real-time audits are made possible by Solana, which gives companies and their customers rapid access to transaction tracking and verification. By providing transparent, unchangeable records of all activity, this transparency strengthens confidence in stablecoins, which is especially beneficial for business-to-business transactions.

Challenges in Stablecoin Development on Solana

While building your stablecoin on Solana you might face some challenges. Below we’ve listed some challenges you should know:

1. Regulatory Obstacles

One of the biggest challenges is navigating the complicated regulatory environment. For the stablecoin to be accepted and last, it is essential to ensure compliance with numerous financial regulations.

2. Keeping Things Stable

It’s crucial to make sure the stablecoin keeps its peg. This calls for strong systems for handling the collateral and reacting to shifts in the market.

3. Security Issues

Stablecoins are vulnerable to security risks because they are digital assets. To guard against fraud and hacking, it is crucial to implement robust security measures and conduct frequent audits.

These are the primary obstacles to developing stablecoins. Eliminating technical issues is essential, to dominate the market. In this instance, a well-known stablecoin in defi creation company solely assists you in creating fully operational currencies.

How Much Does it Cost to Develop Stablecoin on Solana?

Starting a good stablecoin company depends on building and including a strong blockchain infrastructure. Given that this element calls for specialist technical knowledge, safe infrastructure, and continuous maintenance, the expenses connected with it can be somewhat high. Industry estimates range from $500,000 to $2 million for the average cost of blockchain development and integration for a stablecoin company based on project complexity and the degree of customizing needed.

Underlying blockchain development for the stablecoin is one of the main outlays in this category. This can entail putting in place consensus systems, assembling a group of seasoned blockchain developers, and guaranteeing network security and scalability. Furthermore adding major expenses frequently between $100,000 and $500,000 or more is the integration of the stablecoin platform with current banking systems and payment channels.

Maintaining and safeguarding the blockchain infrastructure comes with yet another major outlay. This covers the distribution and control of nodes, the use of strong cybersecurity policies, and continuous platform maintenance and observation. With estimates ranging from $50,000 to $200,000 a year or more, depending on the size and complexity of the stablecoin company, these running expenses can rapidly mount up.

Conclusion

So, you want to create a stablecoin but unsure which platform to choose. Selecting a blockchain platform that has unmatched scalability, strong security, developer support, and cross-chain compatibility is crucial. All of these factors make Solana a great option for your stablecoin development.

Solana handles high transaction volumes without sacrificing performance thanks to its remarkable speed and scalability. The stability of stablecoin ecosystems and the protection of user assets are guaranteed by its strong security features.

Solulab helped NovaPay Nexus, a self-hosted cryptocurrency payment processor that allows businesses to accept digital currencies directly, without fees. NovaPay Nexus offers a secure way to integrate crypto payments, manage multiple stores, and ensure privacy and security. Solulab’s expertise empowered NovaPay to overcome challenges like cryptocurrency complexity and user adoption. Let SoluLab a Stablecoin development company have an expert team to bring innovative solutions to your business today.

FAQs

1. What stablecoin is built on Solana?

Several stablecoins are built on the Solana blockchain, using its speed, scalability, and low transaction costs. A widely-used fiat-backed stablecoin available on Solana, offering fast and cost-effective transactions for payments and decentralized finance (DeFi). Another popular fiat-backed stablecoin integrated into the Solana ecosystem provides liquidity and stability for traders and developers. These stablecoins benefit from Solana’s high-performance network, enabling efficient financial operations across decentralized applications.

2. How can I tokenize assets on Solana?

Assets tokenization on Solana involves using its smart contract capabilities to represent physical or digital assets as tokens on the blockchain. This enables easier transfer, trading, and liquidity.

3. What are real-world assets in the Solana ecosystem?

Real-world assets (RWAs) on Solana refer to tangible assets like real estate, stocks, or commodities tokenized on the blockchain. These assets can be integrated into stablecoin ecosystems to create asset-backed digital currencies.

4. What role does Solana play in tokenizing stablecoins?

Solana facilitates the creation, management, and transfer of stablecoins by offering a secure and efficient blockchain infrastructure. Its tokenization tools ensure integration with decentralized ecosystems.

5. How do fiat-collateralized stablecoins work?

Fiat-collateralized stablecoins are backed by reserves of fiat currency, such as the US dollar, held in a secure account. Every stablecoin created results in an equivalent quantity of fiat money deposited, guaranteeing a 1:1 ratio of one stablecoin equating to one USD in reserve. Maintaining their stability and value set to the fiat asset, users may redeem these stablecoins for fiat money at the same 1:1 ratio. Frequent audits help guarantee by verifying that the reserves match the circulating supply. Stablecoins with fiat-collateralized simplicity and dependability are increasingly employed in trading, payments, and distributed finance (DeFi) applications.