Prices for trading cryptocurrencies can fluctuate, frequently in a matter of seconds. This creates arbitrage opportunities— when traders can buy a cryptocurrency on one exchange at a lower price and sell it on another for a profit. However, capturing these fleeting differences manually is impossible due to time constraints and logistical challenges.

Crypto arbitrage bots address this gap. These automated tools monitor multiple exchanges simultaneously, execute trades with minimal delay, and account for variables like fees and liquidity. Research highlights their effectiveness: Automation is used to some extent by more than 65% of individual retail traders and up to 99% of institutional investors’ activities.

Manual traders struggle with execution delays and high transaction costs, and automated bots have gained popularity. A 127% increase in arbitrage bot usage in 2023 underscores their growing importance in cryptocurrency markets. Additionally, NLP applications are being leveraged to analyze market sentiment and news trends, further enhancing the efficiency of automated trading strategies.

In this blog, you’ll get to know how to create a crypto arbitrage trading bot, its features, benefits, and how much it costs. Let’s get started!

What is a Crypto Arbitrage Bot?

A crypto arbitrage bot is a software tool that tracks algorithms. It identifies price differences for cryptocurrencies across multiple exchanges. These bots buy on platforms where the price is low and sell where it’s higher, aiming to profit from the price gap. These bots work quickly to exploit small, temporary differences in cryptocurrency values.

Why Create a Crypto Arbitrage Bot?

According to recent statistics, traders invest 86% of their money in crypto arbitrage bots. Crypto traders blindly believe in crypto arbitrage bots to make trading decisions. Crypto arbitrage bots offer several compelling advantages. They excel at maximizing profits by capitalizing on market inefficiencies that human traders might miss. During periods of high volatility, these bots can identify and execute dozens of profitable trades per day, operating with a level of precision and speed that is impossible for manual trading.

Moreover, one of the most attractive aspects of arbitrage bots, including triangular arbitrage trading bots, is their democratizing effect on crypto trading. They allow average traders to compete with larger market players by automating complex trading strategies.

- Multiple trading pairs simultaneously

- Various exchanges and markets

- Increasing trade volumes as your capital grows

- Different arbitrage strategies

Arbitrage bots can significantly reduce certain trading risks through Emotional-free trading decisions, Precise execution timing, Advanced risk management algorithms, and Automatic position sizing. Traders no longer need to worry about losses in this fast-moving market because of using a crypto arbitrage bot.

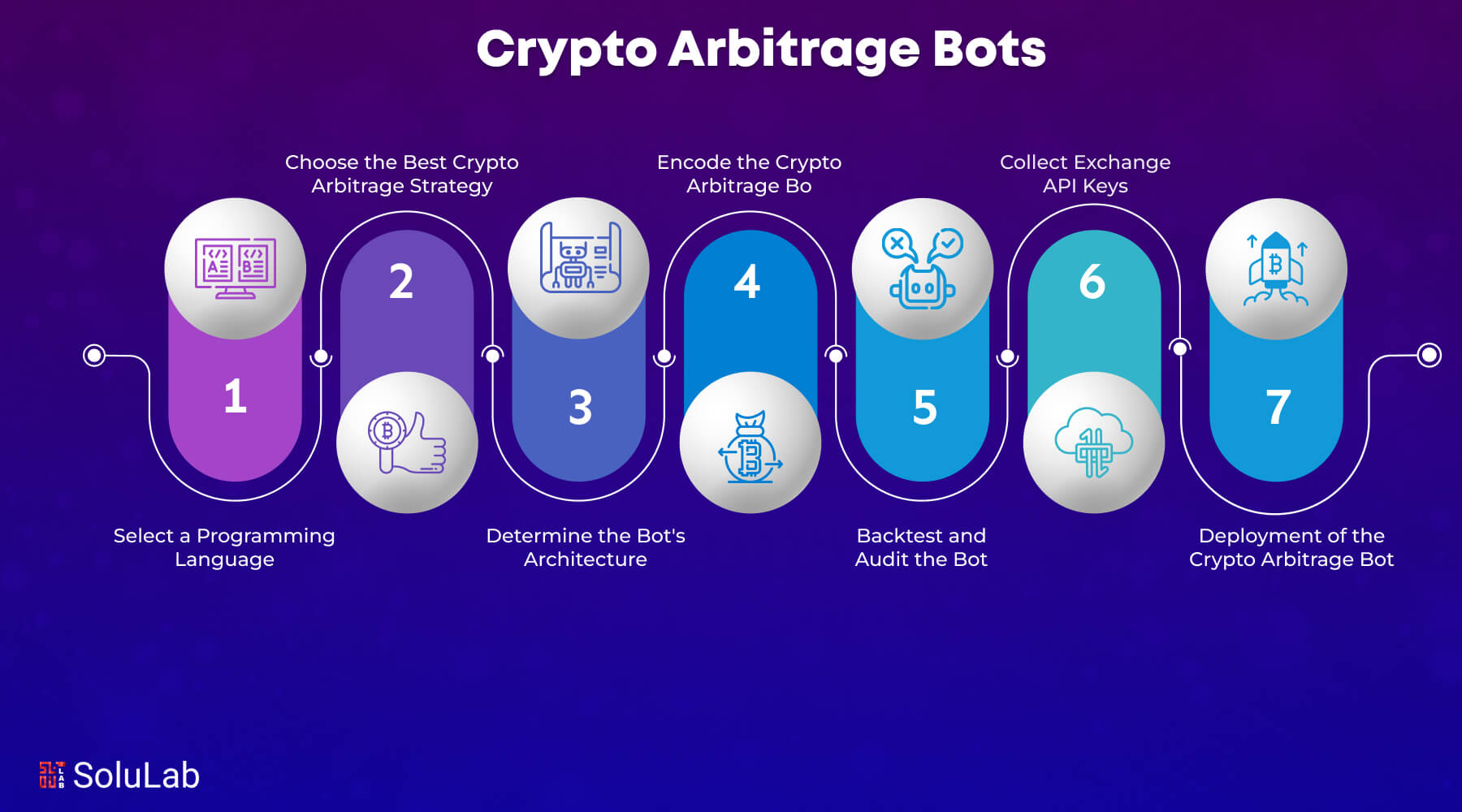

How to Create a Crypto Arbitrage Trading Bot?

Creating a crypto arbitrage trading bot involves several key steps:

-

Select a Programming Language

Choose a language you are comfortable with and suitable for financial applications, such as Java, C#, JavaScript, or Python, which is popular for its ease of use and extensive libraries. Make sure to optimize your parameter by keeping in mind capital. Set maximum trade amount, acceptable profit margins, and stop-loss thresholds to avoid losses.

-

Choose the Best Crypto Arbitrage Strategy

Don’t create a bot without any proper planning. Do some market research and decide which strategy your bot will use, such as spatial arbitrage, triangular arbitrage, or statistical arbitrage, based on market conditions and your goals so that after building, you don’t need to rework or create a new bot.

-

Determine the Bot’s Architecture

After selecting a strategy plan, the architecture of your bot, including components for market data collection, trading decision-making, and execution. Ensure it can handle real-time data and quick trades. Additionally, program your trading bot with the latest updates so it will not make decisions based on the wrong data.

-

Encode the Crypto Arbitrage Bot

You’ve decided on the right programming language and the strategy; now, you need to write the code for your bot based on the architecture plan. Implement the logic for data collection, strategy execution, and trade execution as well. Ensure your code is efficient and secure.

-

Backtest and Audit the Bot

Once you’ve successfully created a bot, that’s not enough. Before deploying, test your bot with historical data to ensure it performs well under various market conditions. Audit the bot to identify and fix any bugs or performance issues.

Check if your added dataset is functioning well or do some comparison. Try to execute the trade on multiple exchanges.

-

Collect Exchange API Keys

Collect API keys from the cryptocurrency exchanges on which you plan to trade. Your bot will be able to access market data and make transactions. Select the best crypto exchange sign in to your account, search for API keys, and connect your trading with your trading account.

-

Deployment of the Crypto Arbitrage Bot

You have done all the processes to create a trading bot. Now, deploy your bot on a reliable server or cloud platform. Monitor its performance closely and adjust as needed to optimize its trading strategy and efficiency. Make sure to backtest again and again and optimize it for better performance.

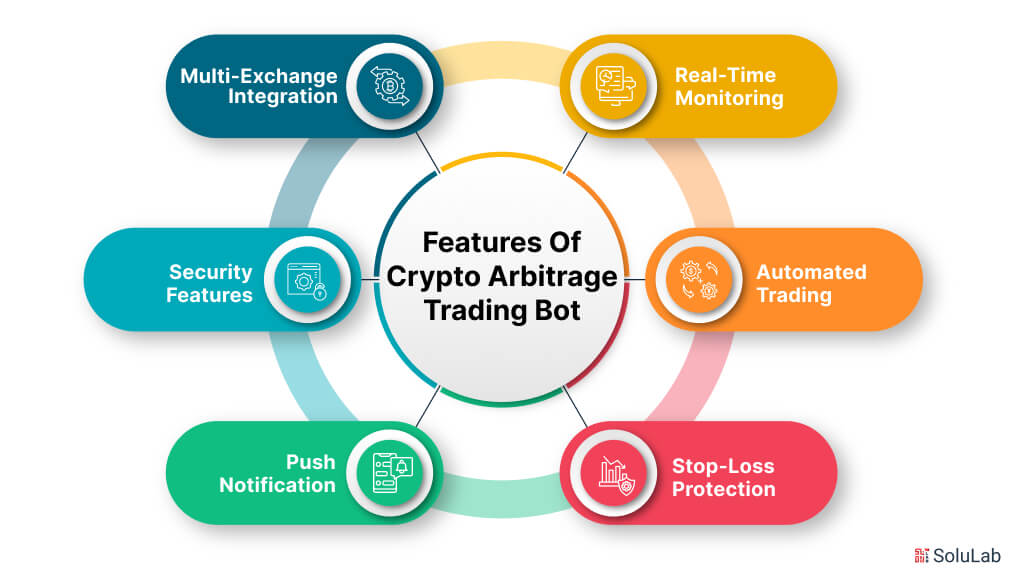

Features of the Crypto Arbitrage Trading Bot

Here are some features of Crypto Arbitrage Trading Bot you should know:

1. Real-Time Monitoring: Crypto arbitrage bots continuously scan multiple cryptocurrency exchanges to identify price discrepancies. They leverage WebSocket connections to receive instant price updates with minimal latency.

These bots maintain a detailed analysis of order book depths to validate trade viability and monitor trading volumes to ensure sufficient liquidity for arbitrage. Additionally, they track spread percentages and calculate potential profit margins after accounting for transaction fees, offering traders precise data for decision-making.

2. Automated Trading: One of the standout features of crypto arbitrage bots is their ability to execute trades automatically across different exchanges whenever profitable opportunities are detected.

Using smart order routing, these bots optimize execution paths to maximize efficiency. They offer customizable trading parameters, such as setting minimum profit thresholds, and support complex strategies like triangular arbitrage within a single exchange and cross-exchange arbitrage. Position-sizing algorithms help allocate resources based on available liquidity, and trading queues are managed efficiently to handle multiple opportunities simultaneously.

3. Stop-Loss Protection: To minimize risks, crypto arbitrage bots incorporate advanced stop-loss mechanisms. Emergency stop features are designed to prevent significant losses by halting operations during adverse market conditions.

Stop-loss adjustments cater to market volatility, while maximum drawdown limits provide an additional layer of risk management. These bots can automatically close positions if network issues are detected, and users can configure separate stop-loss settings tailored to different trading pairs for enhanced flexibility.

3. Push Notification: Keeping traders informed, these bots send time alerts for executed trades and profit or loss updates. Notifications also include critical system statuses, such as connection issues or balance changes.

Traders can customize alerts based on specific market conditions or opportunities, and notifications are delivered via multiple channels, including email, SMS, and Telegram. Detailed trade summaries and performance metrics are included in the notifications, providing insights into trading activities.

4. Security Features: Security is a top priority for crypto arbitrage bots. They employ robust measures such as API key encryption and secure storage to protect sensitive data. IP whitelisting ensures only authorized devices can access exchange APIs, while two-factor authentication safeguards bot configuration changes.

Rate limiting prevents API abuse, and detailed audit logs track all system activities. Regular automated security checks and validations further enhance the system’s integrity, ensuring a secure trading environment.

5. Multi-Exchange Integration: Crypto arbitrage bots support simultaneous connections to major cryptocurrency exchanges, standardizing API interactions across diverse platforms. They manage exchange-specific rate limits and adhere to unique trading rules, ensuring smooth operations. Bots also handle currency conversion and balance management across exchanges, simplifying cross-platform trading.

With a unified interface, traders can monitor all exchange accounts efficiently, and automatic reconnection features address API disruptions, maintaining seamless functionality.

Benefits of Creating a Crypto Arbitrage Bot

As humans, we often overthink a lot and think twice before making any decisions. This is why a crypto arbitrage bot is advantageous: it eliminates delays and executes decisions instantly. Here’s an explanation of the benefits of creating a crypto arbitrage bot.

1. Speed: A crypto arbitrage bot can execute trades at quick speeds, far surpassing human capabilities. The bot can analyze price differences across multiple exchanges within milliseconds and execute trades before these opportunities disappear. This rapid response is crucial because markets often last for just seconds or even fractions of a second. The bot can monitor thousands of trading pairs simultaneously, something that is impossible for a human trader to manage.

2. Emotionless: Unlike humans, bots won’t experience fear, greed, or anxiety that often leads to poor trading decisions. The bot strictly follows its programmed logic and predetermined parameters, ensuring consistent execution regardless of market conditions. This removes emotional bias during sudden price drops or holding positions too long due to overconfidence.

3. Diversification: A well-designed arbitrage bot can work across multiple cryptocurrencies and exchanges at once, creating a naturally diversified trading approach. It can:

- Monitor different types of arbitrage opportunities (triangular, cross-exchange, statistical)

- Trade various cryptocurrency pairs

- Adjust strategies based on market conditions

How Much Does it Cost to Develop a Crypto Arbitrage Bot?

Before you start building a crypto arbitrage bot, conduct market analysis, competitor analysis, and its design. The overall cost of developing a crypto arbitrage will be going into these components. This is why planning is a must. let’s explore the cost of developing a crypto arbitrage bot using some parameters:

- Market Data Research: The research phase involves studying trading volumes, liquidity analysis, and identifying the most profitable trading pairs and certain risks. If you are not an expert, then you must take expert guidance from any blockchain company or service provider.

- Design: Focus on creating an efficient and secure architecture. Your bot needs a risk management system to protect against sudden market movements. The interface should provide clear visualizations of trading opportunities and performance metrics for the app user and interface.

- Development: The total amount required to develop a crypto arbitrage bot is around $10,000 to $75000. Moreover, you might see some changes in cost while building your crypto arbitrage trading bot.

How do Crypto Arbitrage Trading Bots Work?

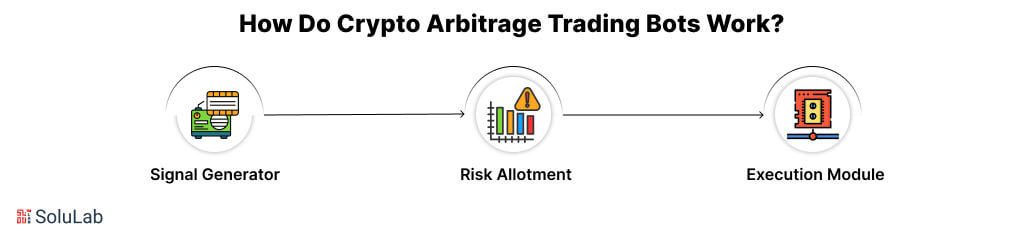

A crypto arbitrage bot operates with three critical components: the Signal Generator, Risk Allotment, and Execution Module.

1. Signal Generator: The Signal Generator serves as the bot’s analytical brain, functioning as an arbitrage signal bot. It compares the prices of identical cryptocurrency pairs (e.g., BTC/USDT) across platforms, calculating potential profits after accounting for factors like transaction fees, spreads, and transfer times, and generates precise buy/sell signals.

2. Risk Allotment: It optimizes position sizing based on available capital and market liquidity while setting maximum trade sizes to avoid slippage in less liquid markets. Additionally, it establishes critical safeguards like stop-loss levels and drawdown and helps you when you should buy or sell stock. For those exploring a crypto arbitrage flash loan bot, it uses optimized parameters as a basis for making decisions, effectively mitigating risk in volatile markets.

3. Execution Module: The execution model manages the buy and sell trade execution process with precision. It strategically trades across exchanges and adjusts orders based on changing market conditions. The execution module converts the signal into API keys that exchanges can consider and manage

How SoluLab Excels in Creating Arbitrage Trading Bots?

Token World, a crypto launchpad platform, wanted a secure and scalable platform for token sales while staying compliant and transparent. SoluLab, the crypto trading bot development company, stepped in to create a tailored launchpad with features like submission forms, review systems, secure transactions, dashboards, multi-language support, and blockchain integration. This solution helped Token World simplify processes, meet regulations, build trust, and handle high traffic effectively, enabling smooth and successful token launches worldwide.

Conclusion

Crypto arbitrage bots represent a powerful tool for traders looking to automate their trading strategies and gain profits on market inefficiencies. While they require an initial investment in terms of time and resources, they can provide a valuable edge in this competitive crypto market. Success with arbitrage bots depends on careful planning, technical implementation, and ongoing optimization to stay ahead of market changes.

Remember that while arbitrage bots can be highly profitable, they’re not a “set and forget” solution. Regular monitoring, updating, and optimization are essential for maintaining their effectiveness.

Our skilled blockchain developers at SoluLab have practical expertise in creating cryptocurrency arbitrage bots. Our experts follow a well-defined plan to guide you through the development of your cryptocurrency trading bot and deliver a top-notch crypto arbitrage bot development solution that gives you a crucial competitive advantage.

To discuss your business use case, get in touch with our subject matter specialists.

FAQs

1. Do crypto arbitrage bots work?

Yes, crypto arbitrage bots work by automating trades based on price differences between exchanges. Their speed and precision outperform manual trading, but success depends on accurate settings, low fees, and market conditions.

2. Is crypto arbitrage profitable?

Crypto arbitrage can be profitable, especially in volatile markets with noticeable price differences. However, profits depend on factors like fees, liquidity, and execution speed. Frequent monitoring and careful configuration are essential to maintain consistent returns.

3. How do I set up a crypto arbitrage bot?

To set up a crypto arbitrage bot, choose a reliable platform, connect it to exchanges via API keys, and configure trading settings like limits and strategies. Backtesting and regular monitoring ensure the bot operates effectively.

4. Which is the best bot for crypto arbitrage?

The best bot varies by need; platforms like Binance, HaasOnline, and Bitget are popular for their advanced features, speed, and user-friendly interfaces. Choose a bot based on exchange compatibility, fees, and strategy support.

5. Why use a bot for crypto arbitrage?

Manual trading is slow and often inefficient for arbitrage. Bots execute trades instantly and monitor markets 24/7 to maximize opportunities.