The value of cryptocurrency fluctuates in milliseconds, making it infamously volatile. It is simple for traders worldwide to invest whenever they want and from any location. While some investors profit from small market movements and inefficiencies, others purchase and keep assets for an extended length of time. The cryptocurrency market is a challenging game to master. Although cryptocurrency development company knows cryptocurrencies and their market, several reasons restrict human bitcoin trading.

Automated trading using tools and bots that make trades and carry out transactions on behalf of human traders, depending on the circumstances, is the answer. These bots are made to make money trading every single day of the week. Traders are executed according to the restrictions and guidelines set by human investors.

What is Arbitrage Trading?

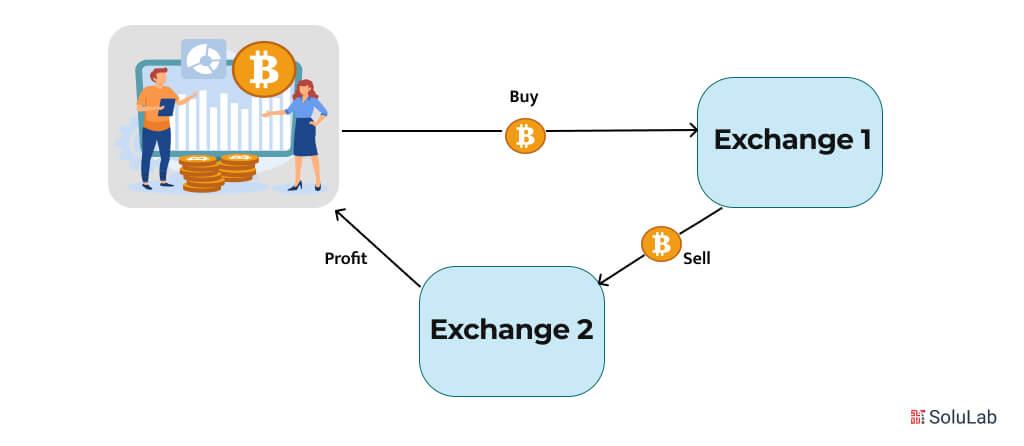

A method for making money based on slight variations in bitcoin values between markets is called arbitrage trading. In the cryptocurrency marketplaces, dealers use arbitrage because there are no set standard prices. There are now hundreds of cryptocurrency marketplaces due to the rising demand for cryptocurrencies, which raises the potential for profits from arbitrage trading.

The act of concurrently buying and selling assets from multiple markets where the prices are much higher than the initial pricing is known as arbitrage. Unlike other tactics, this one minimizes or does away with the danger of market prediction and technical analysis. Although there is no expert or in-depth understanding of the market patterns is needed, it is quite convenient for novices.

What are Crypto Arbitrage Bots For Trading?

Arbitrage Crypto Bot software is the one that analyzes market behavior, including trading volume, order, price, and time is also known as an automated arbitrage bot. They are prevalent in the cryptocurrency space and are made to profit from potential variations in cryptocurrency pricing between marketplaces.

The efficiency and speed of Automated Crypto Trading Bot are their primary advantages. Humans are far less capable of making thousands of judgments that are all intended to produce favorable outcomes than bots. However, you must first understand how cryptocurrency arbitrage software operates to get such outcomes.

The Crypto Arbitrage Trading Bot‘s initial action is to use an API to connect to an exchange and watch the marketplace for any cryptocurrency fluctuations. It then places the proper order and completes the trade after the user-specified conditions are satisfied.

Types of Crypto Arbitrage Bots

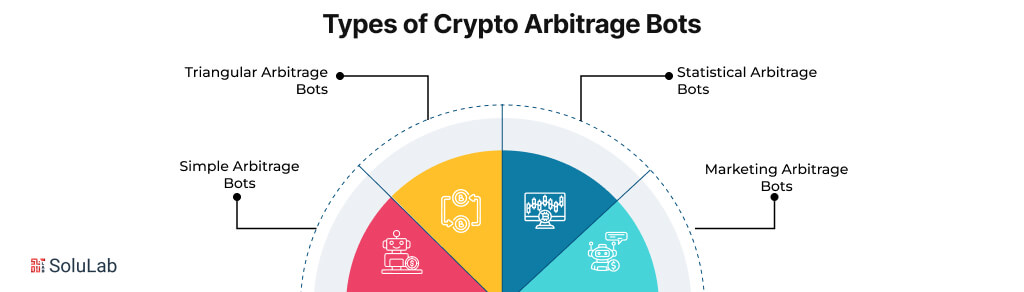

The Real-Time Crypto Arbitrage Bot is made to take advantage of price fluctuations in the Bitcoin market. They work on a variety of exchanges and employ a range of tactics to optimize earnings. The main categories of arbitrage bots are listed below:

-

Simple Arbitrage Bots

The simplest kind of arbitrage bots concentrates on price discrepancies among single or multiple exchanges. They keep a close eye on a few chosen trading pairs and place transactions when lucrative differences appear. They are accessible to inexperienced traders due to their speedy trade execution and relative ease of setup. This crypto trading bot development looks for price differences on exchanges all the time, this development has also made it possible to automatically try to collect the profit margin after deducting transaction fees by buying at a lower price and selling at a higher price.

-

Triangular Arbitrage Bots

These bots take advantage of the price discrepancies between three cryptocurrencies or pairs in a single exchange. They maintain their sights on three interrelated currency pairs, such as ETH/USD, BTC/USD, and ETH/BTC. They identify and execute transactions very instantly using complex algorithms. Triangular arbitrage bots save transaction costs by operating within a single exchange and focusing on smaller spreads.

-

Statistical Arbitrage Bots

To start a cryptocurrency exchange, it finds mispriced assets or cryptocurrency correlations, they rely on intricate statistical models. To identify trading opportunities, they apply machine learning and quantitative analysis approaches. This includes risk controls to lessen possible risks. As these statistical arbitrage bots rely on the examination of historical data, they can spot openings that human traders would miss.

-

Marketing Arbitrage Bots

These bots regularly place buy and sell orders, hence supplying liquidity. To establish a market for certain assets, they keep track of purchases and sell orders, and reduce risk by modifying prices in response to market fluctuations. These bots help the market run more smoothly while making money from bid-ask spreads and trading fees. These bots increase the market liquidity and benefit from the spread by putting purchase orders just above the current market price and placing sales orders just below it.

What Do You Need Crypto Arbitrage Bots For?

Crypto Arbitrage Bot Software represents an essential resource to all traders who want to benefit from the differences in price in exchanges. It helps traders to make trading more efficient by automating activities related to buying and selling. This process allows deals to be executed within a few seconds, making them quite potentially very profitable in the volatile cryptocurrency markets.

-

Improved Speed

The crypto arbitrage flash loan bot can quickly measure price differences across various exchanges and create trades for guaranteed accelerated rates and efficiency in deal execution.

-

Risk Control Improvement

Our arbitrage crypto bot helps improve risk management by preventing losing high-profit deals by identifying price differences. The arbitrage crypto bot executes trades independently of humans, avoiding losses.

-

Earnings Happen Faster

A crypto arbitrage trading bot undoubtedly surpasses several other tactics when it realizes profits. Using a trading bot generates profit as soon as the trade is completed.

-

Research Market Data

For an arbitrage bot for cryptocurrency to allow accurate results to be obtained, it allows users to be able to choose the type of data that should go into the signal generator’s sector.

-

Trading 24/7

Cryptocurrency exchange arbitrage bot is an all-day trading exchange that can make any round-the-clock transaction and watch markets and prices all day long.

-

Unemotional Trading

Cryptocurrency arbitrage chatbot development differs from humans who will emotionally decide that their choices are primarily based on perception rather than a desire for profit or fear of losses. Arbitrage trading bot allows for unemotional trading.

How to Build A Crypto Arbitrage Bot?

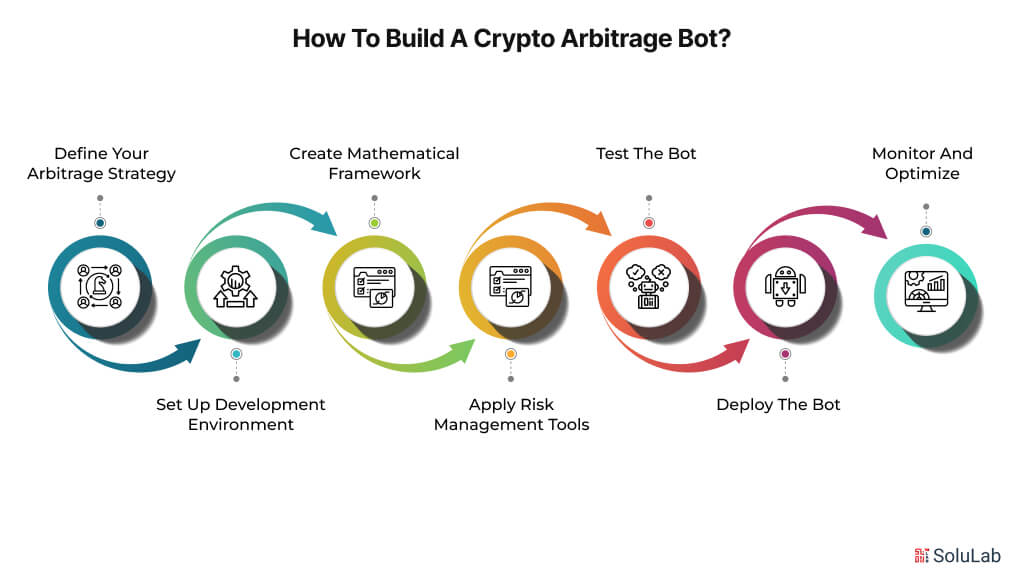

Now you are clear about what a crypto arbitrage bot and why is it used, here is the breakdown of how to build a crypto arbitrage trading bot.

Step 1: Identify Your Course of Action for Arbitrage

When defining an arbitrage strategy, take into account the following:

- Arbitrage type: Frex is available in terms of temporal arbitrage, which is to take benefit from variations in pricing over time, or spatial arbitrage where a party profits out of variations in price over space accessible in numerous exchanges.

- Select the Cryptocurrency: Select which type of coins would you like to use with your bot.

- Risk control: More trading rules should be set, in the format of the maximum amount for trading, the most profitable level, and loss-bearing limits.

Step 2: Make your environment ready for Development

Choose the programming language to design the cryptocurrency trading bot, and you can use Python, JavaScript Node.js, or C#.

Step 3: Establish mathematical theorem-like structures

Based on the current situation of several exchanges, make good use of the APIs therefore gathering real-time market data. In this case, use the reasoning to look for arbitrage opportunities in line with this plan.

Step 4: Use of the Risk Management features

Risk management may arguably be one of the most critical aspects when it comes to creating a crypto arbitrage bot. Equip your bot with risk management potentialities. This entails setting desirable profits as well as the prohibited amounts of transactions together with mechanisms of minimizing the probability of losses such as stop–loss.

Step 6: Evaluate the Bot

The good news is at this stage of the game, it’s recommended to carry out a viability test in a virtual environment or a test box. For a variety of scenarios, for example, when there are connectivity problems within a network, API rate limiting, or changing market conditions.

Step 7: Put the Bot into Action

After testing has been completed the bot should be taken into a real live trading environment. Avoid risks as much as you can, first of all, use a little of it, and then observe its performance closely. Besides, as will be discussed later on, due to actual market conditions, it can be necessary to make changes in the appearance of the bot.

Step 8: Monitoring and Improving

Keep a close eye on the improvements in your bot’s performance and adjust the settings as needed. It is also crucial to look after the operational efficiency of the exchange of APIs, the state of the market, and any regulatory changes that could affect your business.

Risks Involved With Crypto Arbitrage Bot Trading

This crypto trading bot might be a tempting method for traders and investors who are working after taking advantage of price differences between various cryptocurrency exchanges, but they come along with risks which are mentioned below:

1. Risks of Execution

The risk of execution is one of the major dangers involved in trading with crypto arbitrage bot development. When the price differentials between exchanges narrow before the bot can even finish the trade, this happens. As arbitrage frequently lasts only a few seconds, the speed at which these bots are operating is crucial. Potential gains may disappear if a bot doesn’t complete a trade fast enough, resulting in losses instead.

2. Volatility of Market

There is an additional element of risk due to the cryptocurrency market’s intrinsic volatility. Quick price changes can change protected earnings and raise the risk of possible losses during the trade. Profitability may decline with the heat-up situation of arbitrage opportunities and more traders use automated tactics.

3. Security and Technical Issues

Another major risk involved while trading using a crypto arbitrage bot is the technological difficulty of configuring and maintaining these bots. Configuration might be difficult for novice traders, which can result in incorrect operations or lost opportunities. Additionally, security flaws also pose a possible concern for users. Hackers target these bots as they require access to user’s API keys and exchange accounts.

4. Cost Factors

The risks associated with utilizing arbitrage bots are also significantly influenced by cost considerations. Network expenses, trading, and withdrawal are just a few of the fees that traders have to consider. These fees have the potential to drastically reduce profit margins. Furthermore, a lot of exchanges have withdrawal restrictions which might make it even more difficult to quickly make profits.

The Best Crypto Arbitrage Bots of 2025

To assist you with even more ease, we have compiled a list of the top currency trading bots for all investors, covering all budgets and strategies. Here is a quick list of the best crypto arbitrage bots to look into in 2025:

| Supported Platform | Price | Used For |

| Mizar | $89-Free/month | Used for social media and copy trade. |

| Pionex | Free | Used for trading bots for cryptocurrency. |

| Cryptogopper | Free or $107.50/month | Used for AI Automation. |

| Altrady | Free or $89/month | Used for customized trading bots. |

| Hummingbot | Free | Used for expert market makers and liquidity suppliers. |

| Tokensets | Free | Used for trading bots for DeFi cryptocurrency. |

| HassOnline | $9-$99/month | Used for private cryptocurrency trading bots. |

| Coinrule | $449.99/month | Used by beginners cryptocurrency trading bots. |

| CryptoHero | Free-$29.99/month | Used for trading simulation. |

The Future of Crypto Arbitrage Trading

The future of cryptocurrency arbitrage trading is expected to be shaped by various trends as the industry continues to change. Businesses hoping to maintain their market and leadership will need to strategically navigate these developments. AI-powered chatbots will come to explore the increased diversity of opportunities beyond centralized and traditional exchanges. This growth into a decentralized platform shall be a sure source of new techniques in arbitrage. ML and AI shall catalyze a further revolution in the capabilities of these bots.

These bots will be able to evaluate vast quantities of data, identify complex patterns, and adjust their trading strategies in real time to capitalize on short-lived market opportunities by leveraging AI and ML algorithms. The predictive power achieved through this increased ability will significantly enhance the accuracy and effectiveness of arbitrage trades. Cross-chain platforms would also play a significant role in how arbitrage trading trends are developed going forward. Cross-chain arbitrage will provide more possible arbitrage opportunities in that bots will be able to exploit the price discrepancies across multiple blockchain networks.

This will also boost the adaptability and profitability of these complex trading systems. Along with this, the security issues of the sector will be a major concern. Therefore, future arbitrage bots are likely to provide strong security features, including privacy-centric features to protect the user’s assets and sensitive information.

Discover How SoluLab Enhances Your Trading Experiences

Cryptocurrency arbitrage bots are a powerful weapon for traders who seek to profit from the inefficiencies in the markets. Perhaps, you’ll achieve higher trading effectiveness and new heights of revenue by employing their importance and state-of-the-art tools, including SoluLab. Are you ready to transform your experience in trading cryptocurrencies? These new-generation cryptocurrency arbitrage bots are from SoluLab designed to help you maximize profits while minimizing your losses.

SoluLab’s Token World is aimed towards establishing a leading cryptocurrency launchpad that will serve as a conduit for blockchain initiatives in need of funding and for investors wishing to find and become involved with promising companies. The site is made to provide an easy-to-use interface for investors to view a well-chosen list of projects and for project developers to list their initiatives. Token World works to improve the overall efficiency of the blockchain ecosystem by streamlining investments and projects.

This is your best opportunity that should not be ignored if you want to enhance your trade knowledge. For more information regarding our crypto arbitrage services or to make a start towards your successful financial life, contact SoluLab now. Are you ready for a better cryptocurrency trading strategy? To know how our innovative solutions can help you in achieving your financial goals, contact SoluLab immediately.

FAQs

1. Are crypto-trading bots effective?

The markets and their level of volatility at any one time determine whether or not a crypto arbitrage trading bot is profitable. By purchasing various cryptocurrencies at varying prices and then selling them afterward at a much higher price.

2. How to Make a Crypto Arbitrage Bot?

A trading bot can be created using a variety of languages, including C++, Java, JavaScript, Python, and others. However, Python is particularly well-suited to managing large amounts of financial market data, including time series data and historical trading records.

3. Which arbitrage bot is the best?

A leading platform for cryptocurrency arbitrage trading, Karen offers a large selection of assets together with strong security. Its sophisticated arbitrage trading algorithms let users profit from price differences across many exchanges and markets.

4. To what extent you can profit from arbitrage?

Although you can make more, it is reasonable to aim for a monthly profit of 10-20% of your entire bankroll, the length of time that spend arbitrage betting is one of the most important considerations.

5. How is SoluLab assisting with crypto trading operations?

By offering a variety of services, such as blockchain consultancy, wallet development, smart contracts, token creation, and blockchain integration for different industries SoluLab is assisting crypto trading operations.