Multi-Party Computation technology has been in existence for a quite while. Still, its applications with Web3 wallets have just begun to provide an improved foundation for better user experiences, increased security, and streamlined transactions. EVM compatible blockchains account and Ethereum is paving the way for web3 wallets, an enhanced version of traditional wallets available today. Many smart accounts are turning in different directions of smart wallets such as MPC Wallets.

Apart from traditional methods like seed phrases MPC wallet works by dividing private keys into multiple parts to ensure that the keys are not focused on a single-point failure. With different ways of working, MPC wallets also provide the majority of advantages. Even though there are questions raised about its decentralization, MPC wallets maintain a fair balance between security and personal user experience.

This blog will cover a brief introduction to what is an MPC wallet, why you need it, and How does MPC Wallet works. and the benefits it holds for you as a customer.

What is Multi-Party Computation (MPC)?

Crypto Wallet Rise allows parties to compute a function for their inputs altogether while keeping their inputs private at the same time from each other. To put it simply, you could think of it as many people solving a puzzle together without letting others know about the pieces they hold.

When it crypto wallets, it means that private keys are always in a whole form, and never in a singular. They split into different pieces to be distributed. Later these parties compute their private keys without actually reconstructing the original one.

This is what makes it different and better to safeguard a crypto wallet than a cold wallet. When you use a cold wallet, the private keys are stored on the same device, not the case when you use a multi-party computation wallet!

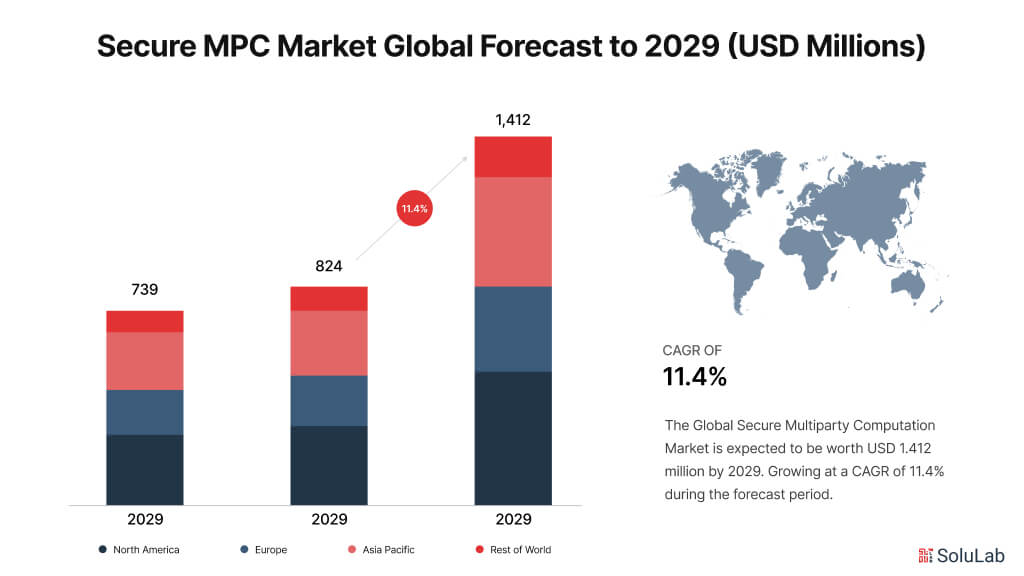

The global secure multiparty computation market size is projected to grow from USD 824 million in 2024 to USD 1,412 million by 2029 at a Compound Annual Growth Rate (CAGR) of 11.4% during the forecast period.

What is an MPC Wallet?

MPC Wallet, or a smart contract wallet that can leverage multiple-party computation technology, allows multiple parties to control and manage digital assets on the blockchain.

Other than different wallets (EOAs), that solely rely on a single private key, MPC wallets meaning use advanced cryptographic technology, to ensure that the private key is neither exposed to nor stored in a single direction, adding an extra layer of security.

Multi-party computation wallets are crucial for the web world, offering security, flexibility, and strong control over online transactions. They enhance the web experience by ensuring the safety and convenience of digital assets. It also allows multiple parties at once to be a part of the management that undergoes in digital assets, secure multi-party computation enhance risk mitigation and security for an even more efficient transfer and asset management, provide advanced control, and streamline joint connections of multiple parties.

How Does an MPC Wallet Work?

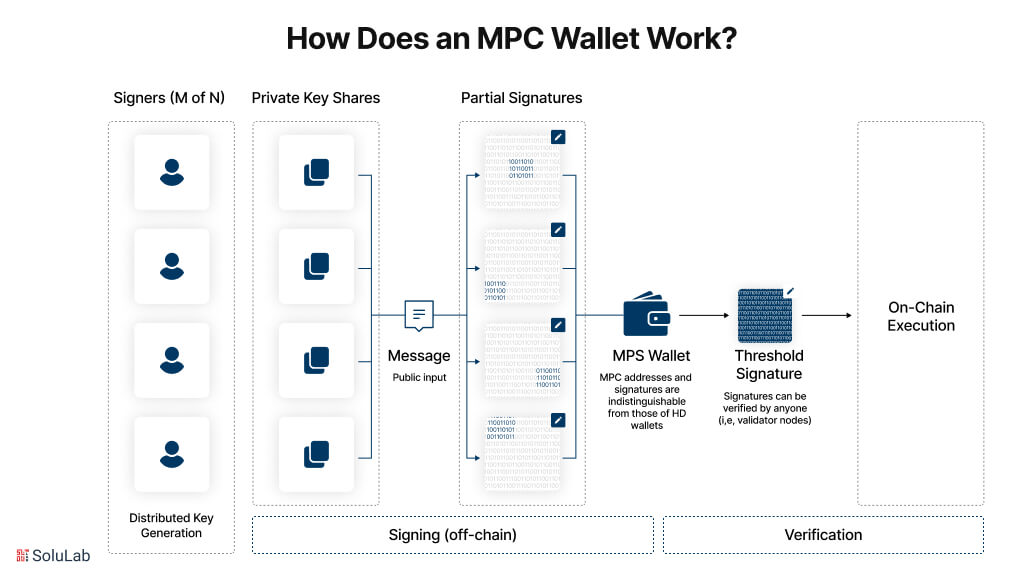

Multi-Party Computation Wallets are the new way of securing payments. They are providing a secure and private landscape for cryptocurrency transactions and storage. Here is a step-by-step guide for how mpc multi-party computation makes this security and advanced ways happen:

1. Generating Keys

Creating private and public keys inside the wallet is the process called Generating Keys. It also includes the registry of these private and public keys, like this the devices are used to unlock objects that are producing a set of public and private keys, later these are combined with other devices for producing private and public keys for the MPC wallet. This approach not only divides the control over the keys but also makes it difficult for hackers to seize them.

2. Distribution of Shares

Once keys are generated, shares are generated. These generated shares are distributed to different parties or servers. These parties can also be a combination of hardware security modules, cloud servers, or even mobile devices in the name of the wallet owner. This distribution of shares among various entities is important for MPC wallets, due to this, it can terminate the single point of failure.

Read Blog: Top 8 NFT Wallets

3. The Sign Process

When the user attempts to open a deal or order through other commands, a signature is created in the MPC protocol that vouches for and verifies the involvement of all other users. If the signature is lawful, the command can be accepted. In another event, if the signature is illegal, then the command is unauthorized, which makes the user appear suspicious.

An MPC wallet would typically use ECDSA signatures. The private key is kept private and cannot be recovered by an attacker by running the SSSS key generation and key sharing protocols. The ECDSA signature is publically verifiable as it will be revealed to the MPC participants in the MPC protocol.

4. Verification

All the parties involved in MPC protocols have access to public keys which are published by the user for the signature. This verification varies by a signature algorithm, but each signature could be verified individually from the published public key by each user. As soon as the signature is published, anyone with the public value can verify the validity of the signature.

What are MPC Wallets Used for?

MPC multi-party computation wallets are creative solutions designed to enhance the security and manage digital assets. Unlike traditional wallets, MPCs do not rely on a single private key, Multi-party computation wallets distribute these keys into multiple shares. Here are the key reasons why MPC wallets are used:

-

Team Wallets for Business, DAOs, Groups

Multiple stakeholders work together to administer the digital wallet and approve transactions, which makes MPC wallets an effective tool for secure cooperation and decision-making. DeFi development companies, organizations, businesses, and project teams that require an effective and safe method of managing assets.

-

Banking Services

With the help of partners holding private key shares, MPC wallets can enable safe escrow services that guarantee transactions only proceed when all requirements are satisfied.

Check Out Our Case Study: Digital Wallet App Success Story of Mobyii

-

Shared Wallets for Investing Parties

MPC wallets allow investor groups to manage their investments collaboratively, requiring agreement on transactions and allowing decision-making in group settings.

-

Custodial Services and Exchanges

MPC wallets help custodial services and exchanges improve their security by distributing and preventing single points of failure for user assets’ private keys.

Pros and Cons of Having an MPC Wallet

Pros of MPC Wallets |

Cons of MPC Wallets |

| Strengthen Security with private key shares: MPC wallets split the private key into multiple shares that are given to other parties. This method lowers the possibility of theft and also reduces risk. | Added Complexity: As MPC wallets require multi-signature approvals and distribute private key shares, they can be more difficult to set up and maintain than single-signature wallets. |

| Better Permissions and Access Control: MPC wallets let users specify roles and duties for each participant, offering more precise permission and control settings. | Slowing in transaction times: The speed of transactions through an MPC wallet can be slower than that of a single-signature wallet since it requires multiple signatures for the transactions. |

| Streamlined Cooperation and Decision-Making: MPC wallets promote cooperation and group decision-making by requiring several parties to approve transactions. | Requires more technical Knowledge: Setting up and managing an MPC wallet usually requires advanced levels of technical expertise. A user should be in a position to manage the multi-signature procedure. |

| Supports Complicated Payments: MPC wallets can handle intricate transaction requirements like spending caps, multi-step approval procedures, and time locking. | Restricted uptake: Not all wallet providers are offering MPC wallets. Despite the benefits, MPC wallets are not generally available and are provided by only a few wallet providers. |

| Supporting EVM Blochains: MPC wallet complaint with the ERC-4337 standard can function on any EVM- EVM-compatible blockchain. | Restricted uptake: Not all wallet providers are offering MPC wallets. Despite the benefits, MPC wallets are not generally available and are provided by only a few wallet providers. |

Four Levels of MPC Wallet

1. Storage Only MPC Wallets

Just Storage MPC wallets are primarily designed for the safe storage of digital assets. Here, the private key is divided into several shares that are kept in different locations. This minimizes the risk of theft or loss since no given individual can access the full key.

Important traits:

- Decentralized key management: This dramatically reduces the risk of a single point-of-storage attack by electronically dividing and storing the private key at multiple locations.

- Improved Security: As the key is no longer wholly reconstructed at one point, the possibilities of gaining unauthorized entry are now minimal.

Due to this, storage-only wallets are of most interest to individuals and companies that put the safety of the possessed assets over the frequency of transactions. These storage-only MPCs are best suited for businesses and organizations that are working to manage huge transactions securely.

2. User Server MPC Wallets

User Server MPC Wallets—Users are in control of servers and server administration. Configuration of this kind offers users the possibility to use server capabilities for performing transactions while still being in control of their private key shares.

Important features:

- User Autonomy: The ability of users to manage their assets independently of any third-party services since they directly have authority over their key shares.

- Collaborative Security: Multi-party permission is still required for transactions, much like server-only wallets, but users can contribute to decision-making, opening up and increasing confidence.

This model will be very helpful to organizations that need to keep some degree of control over their digital assets and need a high level of security. It works well for firms that value security above all else but conduct a lot of transactions.

Read Our Blog: Multi-Signature Wallets: Secure Your Crypto Transactions

3. Server Only MPC Wallets

One level higher, Server Only MPC wallets, integrate server-side processes within the key management procedure. In this scheme, transaction requests and approvals are processed by dedicated servers that hold and process the private key shares.

Important properties:

- Operational Efficiency: This can increase the speed of transaction approvals while at the same time retaining high security by centralizing computing activities on servers.

- Multi-Party Approval: Several server nodes should agree to something; no single server should be in a position to approve a transaction unilaterally. This kind of collaborative approach improves accountability and security.

Therefore, single-server wallets would be ideal for organizations or companies that process large volumes of transactions and need to do so securely. They will fit financial institutions and corporate treasury management since they balance security with operational effectiveness.

Read Blog: How to Create a Wallet like Phantom?

4. Configurable MPC Wallets

The most flexible option in this respect is configurable MPC wallets, which allow users to define key management and transaction approval procedures at will. This level of MPC wallet can be tailored for different needs of operations, such as company policies and regulatory compliance.

Key properties:

- Tailored Security Protocols: This means that tailoring of the security protocols is enhanced by the ability of the user to set the number of parties required to approve transactions and the distribution of key shares.

- Integration of Existing Systems: As configurable MPC wallets can be fitted into other security protocols and systems, they can be applied in several corporate contexts.

These wallets are perfect for businesses planning to implement some security configurations or operate in a regulated industry. They enable businesses to adjust their digital asset management plans in a specific way.

How do MPC Wallets Ensure Security?

You require both public and private keys to access your digital assets, the security of this private key is what ensures that you can hold and transfer the asset without any risk involved. Someone else can only move the assets into their wallet if they have the key in their possession. Consequently, preserving the security of digital assets depends on preventing the theft of private keys. Private key storage has traditionally been available in a few ways. These choices typically relate to hardware-based, cold, or heated storage.

- Hot Storage- Online storage of the private key

- Cold Storage- Offline storage of the private key

- Hardware Wallet- A physical device that is used to store the private key offline

Although these technologies were the only ones available for storing digital assets at one point, new solutions like multi-party computation have emerged as the result of operational and security flaws in each of them. Crucially, multi-party computation use cases are effective for both storing and transferring digital assets. As the market for digital assets has expanded, so too has the necessity for a security solution that permits quick transfers and commercial tactics.

Examples of Top MPC Wallets

Quite a number of the best mpc wallets have come out as secure means of managing digital assets. Here are some notable multi-party computation examples:

- Zengo: With an excellent record as a safe self-custodial MPC wallet, Zengo makes asset management easier while providing stronger protection against unauthorized access.

- OKX Wallet: This wallet has strong features that give users an easy way to manage different cryptocurrencies, due to its sophisticated security features, hence this makes it one of the favorites for many cryptocurrency lovers.

- Web3Auth: Wallet-as-a-service infrastructure that is friendly both to dedicated developers and end-users, Web3Auth uses MPC technology to bring improved security to users without the need for seed phrases.

- Sepior: This wallet platform enables users to safely deal with a variety of digital cryptocurrencies by utilizing the latest MPC technology to deliver a multi-asset management solution.

The Final Word

Open the future of safe digital payments with the assistance of understanding our detailed guide to MPC wallet. Discover why the administration of your digital assets is better, safer, and more confidential with the assistance of a Multi-Party Computation solution with DeFi Wallet Development Company. Learn what are the benefits, what makes MPC wallets distinct, and what steps are advised to be taken for employing MPC wallets for the protection of financial operations.

Are you ready to boost your payment facilities online? You have the opportunity to become partners with SoluLab now! The sellers in our platform are well-informed to provide safe and efficient transactions because they have enough knowledge in creating the MPC wallet. Our clients face difficulties in addressing the issues of payments and safety in the digital environment while ensuring high levels of user-friendliness to the service. To start making changes that can dramatically impact the payment space you should contact us immediately!

FAQs

1. What kind of Wallet are MPC Wallets?

Smart contract wallets or MPC wallets for short, enable multi-party computation to securely handle the Ethereum blockchain digital assets.

2. Are MPC Wallets prone to hacking and theft?

As MPC wallets are providing better security in comparison to traditional single-signature wallets, still no wallet is entirely invulnerable to hacking. With the nature of the distribution of private keys, MPC wallets make it much more difficult for unauthorized access.

3. What is done when another party holding the private key is unavailable?

MPC wallets can be set up with rules that only require a specific number of parties to approve a transaction, even if someone is unavailable the transaction can take place successfully and securely.

4. How to switch from a traditional wallet to an MPC wallet?

You can simply create a new MPC wallet account and transfer your funds securely, ensuring double protection for your digital assets.

5. What type of blockchain services is it offering?

SoluLab’s main focus is on the field of MPC wallet and staking solutions, as well as multichain API. For more precise information on the above information, visit their official website or speak to an expert.