Digital real estate is not a new phenomenon, but it is receiving a lot of focus right now due to the metaverse’s quick expansion and the internet’s overall growth.

Investors are considering purchasing digital property to diversify their portfolios, while real estate businesses are actively promoting their properties in the metaverse to increase brand awareness and earn from rentals.

If you are a knowledgeable real estate investor, you are constantly seeking the next great thing. Like many other aspects of life, real estate is becoming more and more digital. There have been many new and exciting themes emerging in the digital world, including digital real estate.

But is digital real estate investment worthwhile? Will it be like the dot-com bubble of the 2000s? Read on to discover the fundamentals of digital real estate: what it is, how it affects you, and how it is changing the future of real estate.

What is Digital Real Estate?

The real estate sector is among the oldest in the world. Around the same time, it constitutes one of the most rapidly rising industries. If we combine these two realities, we can see that real estate has encountered a significant challenge: transforming its brick-and-mortar procedures into digital ones. For the record, 58% of real estate businesses said they already had a digital strategy. So, if you want to thrive in the real estate market, you must act quickly.

Digital real estate refers to virtual properties or assets that exist in the digital world rather than the physical one. These assets can include domain names, websites, virtual land in the metaverse, social media accounts, and other digital assets that have monetary value and generate income. Just like physical real estate, digital real estate investing involves purchasing, developing, and selling virtual properties to generate revenue. The digital real estate meaning has expanded in recent years, especially with the rise of the metaverse, blockchain technology, and NFTs, allowing investors to diversify their portfolios.

The best digital real estate investing strategies often involve acquiring high-traffic websites or sought-after virtual land and reselling them at a higher price, or earning passive income through digital advertisements and affiliate marketing. With the growing interest in virtual spaces, the question of what is digital real estate investing has become increasingly relevant for modern investors seeking new opportunities.

The Importance of Real Estate Digital Transformation

After understanding what digital real estate entails, the next crucial question is: why does it matter so much? To address this, it’s important to examine two perspectives: the business view and the customer view.

From a business perspective, digital transformation in real estate is vital for staying competitive in the market. Deloitte reports that 41% of real estate companies have already accelerated their adoption of technology and tools to redefine processes. This involves utilizing smart contracts, multiple CRM systems, and other digital solutions that streamline operations, reduce costs, and enhance appeal to investors, potential employees, and customers.

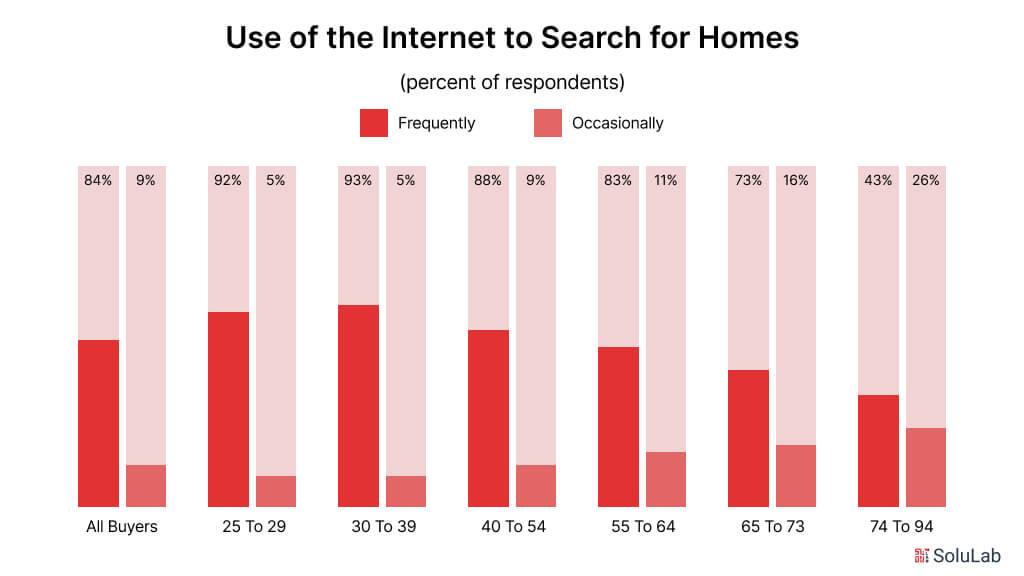

From a customer perspective, digital transformation in real estate is essential to meet the changing demands of modern buyers. A survey by Homes.com, which involved 2,000 home buyers, revealed that 44% felt anxious during the home-buying process. Furthermore, 95% of home buyers in the U.S. used the internet to search for homes in 2021. These statistics emphasize the need for real estate digital transformation to address customer expectations and provide a more seamless experience. Investing in real estate technology is crucial to remain relevant in today’s market.

Why Do People Buy Digital Property?

People buy digital property for many of the same reasons they invest in real-life real estate: to generate income, build wealth, and capitalize on growing markets. Digital real estate investments offer unique opportunities, such as purchasing virtual land in the metaverse, owning high-value domain names, or acquiring profitable websites. The following are a few reasons for purchasing digital property:

-

Income Generation

Just like real-life real estate, digital properties can generate income through various streams, such as renting virtual land in the metaverse, earning ad revenue from websites, or monetizing social media accounts.

-

Wealth Building

Digital real estate investments offer long-term growth potential. As virtual spaces, domains, and websites appreciate in value, they provide an opportunity for investors to increase their wealth over time.

-

Accessibility through Real Estate Tokenization

Real estate tokenization platforms allow people to invest in digital properties by purchasing fractional ownership. This makes digital real estate more accessible, offering investors an opportunity to enter high-value markets without needing large upfront capital.

-

Diversification of Investment Portfolio

Buying digital property helps investors diversify their portfolios, reducing reliance on traditional assets while capitalizing on the growing digital economy.

-

Innovative Opportunities

As the digital world continues to expand, early investors in digital real estate can secure valuable virtual assets, providing a strategic advantage in emerging markets such as the metaverse and decentralized platforms.

6 Key Components of Real Estate Digital Transformation

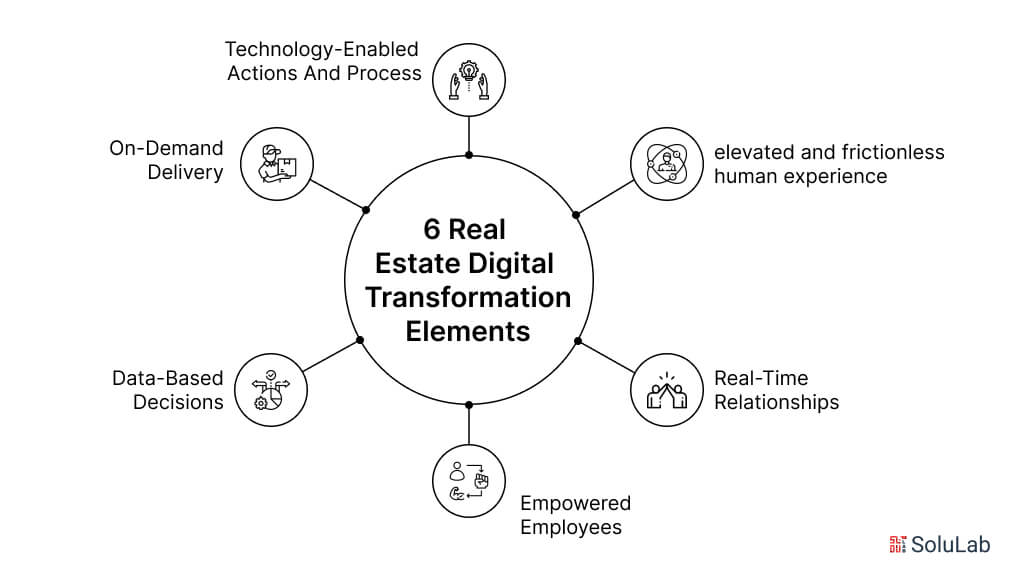

Digital transformation in real estate is a complex concept. To define it more clearly, Deloitte’s recent report identified six essential elements that characterize this shift.

Real estate digital transformation is revolutionizing the industry by introducing advanced technologies that enhance operational efficiency, improve customer experiences, and enable better decision-making. These are the six main components propelling this change:

-

Elevated and Frictionless Human Experience

Digital transformation aims to make the real estate process smoother and more user-friendly. By reducing complexity, it enhances the overall experience for buyers, sellers, and renters, simplifying interactions and making transactions more efficient.

-

Real-Time Relationships

The focus in real estate is shifting from simply providing physical spaces to creating personalized and real-time interactions. Technology enables stronger, more immediate connections between tenants, landlords, and service providers, fostering a more interactive and collaborative environment.

-

Empowered Employees

Through automation and digital tools, employees in the real estate sector can work more efficiently and effectively. Technology allows for better communication, streamlined processes, and reduced manual tasks, resulting in higher productivity and improved work-life balance.

-

Data-Based Decisions

Real estate decisions are increasingly driven by data. With access to comprehensive, real-time information, stakeholders can make more informed choices about property investments, pricing, and market trends, leading to smarter, data-driven outcomes.

-

On-Demand Delivery

The demand for flexible and immediate services is growing, and digital transformation supports this by enabling on-demand solutions. From short-term rentals to quick access to services, the real estate industry is adapting to provide more dynamic, customer-centric offerings.

-

Technology-Enabled Actions and Processes

Advanced technologies, such as cloud-based systems and smart contracts, streamline real estate operations. These tools enhance efficiency across the entire transaction process, reducing delays, increasing accuracy, and providing a more seamless experience for all parties involved.

How to Invest in Digital Real Estate?

Investing in digital real estate is becoming increasingly popular, offering new opportunities in the virtual world. Whether you’re seeking to expand your investment portfolio or explore innovative assets, here’s how to buy digital real estate and invest in it:

-

Understand Digital Real Estate Investments

Digital real estate involves purchasing virtual properties on platforms such as metaverse spaces, websites, or domain names. These assets, like physical real estate, can increase in value over time, making them appealing to long-term investors.

-

Choose a Digital Platform

The first step in investing in digital real estate is selecting the right platform. Popular options include metaverse platforms like Decentraland or The Sandbox, where you can buy and develop virtual land. Additionally, purchasing domain names or building websites is another way to invest in digital properties.

-

Research the Market

Thorough research is essential before making any digital real estate investments. Analyze the demand for virtual land, popular metaverse platforms, and their potential for growth. Understanding these factors will guide you in making informed decisions on how to buy digital real estate.

-

Buy Digital Real Estate

Once you’ve chosen a platform and completed your research, the next step is purchasing your virtual property. Many platforms require cryptocurrency, such as Ethereum, to complete the transaction. Be sure to familiarize yourself with the specific requirements of the platform you’re investing in.

-

Develop or Lease Virtual Properties

After acquiring digital real estate, you can develop the virtual land by building virtual experiences, services, or stores. Alternatively, you can lease the space to businesses or individuals, creating a passive income stream from your digital asset.

-

Monitor and Adjust Investments

Like traditional real estate, digital properties require ongoing monitoring. Stay updated on trends, platform changes, and market conditions that may affect the value of your investment. Modify your approach to guarantee optimal benefits.

By following these steps on how to invest in digital real estate, you can access a growing market and capitalize on opportunities in the virtual property space.

4 Trends in Digital Real Estate

The digital real estate revolution is already in motion, and staying informed about the latest trends is crucial. By keeping up with these developments, you’ll not only learn how to invest in digital real estate but also rethink your traditional property investments. The top four digital real estate trends include:

1. Decentralized Finance (DeFi)

Decentralized finance (DeFi) refers to blockchain-based financial services that automate workflows for financial decisions. The “decentralized” part means there are no intermediaries managing these services. Instead, smart contracts in DeFi — sets of programmed rules on the blockchain — control the process. In the past decade, we’ve gradually shifted towards DeFi, with money already being predominantly digital (only 8% of the world’s currency exists in physical form). In digital real estate, DeFi development plays a central role in every transaction. Unlike traditional real estate, where transaction histories can be obscure and manipulated to raise prices, the DeFi ecosystem ensures that every NFT property transaction is publicly accessible, creating transparency and making it difficult to exploit the system. DeFi enhances accessibility and honesty in digital real estate investments.

2. Tokenized Asset Sales

Traditional real estate transactions involve multiple intermediaries, and an investor must typically hold their investment for the entire project duration. Returns on investment are only realized when the property is sold or refinanced. Meanwhile, brokers, transfer agents, and service providers accumulate fees, and settlements can take days with high costs and limited pricing information. In digital real estate, however, assets are tokenized and stored on the blockchain, resulting in faster transactions, improved pricing transparency, and a reduction in expensive intermediaries. Tokenization also enables fractional ownership, allowing multiple investors to co-own a property through tokens. This makes digital real estate investments more liquid, as shares can be bought and sold more easily, attracting a larger pool of investors by democratizing the market.

3. Personalization & Individuality

In digital technologies like the metaverse, users can create personalized worlds, designing properties and avatars according to their preferences. This gives brands unique access to consumer desires, enabling them to develop goods and services tailored to individual needs.

The customization capabilities of metaverses allow users to explore their creativity freely. For brands, this presents an opportunity to tap into immersive experiences. In the future, this trend could extend to real-world real estate, providing insights into which building designs and amenities tenants prefer, thus helping developers and architects shape physical properties based on real-time feedback from digital spaces.

4. Focus on Location

The COVID-19 pandemic reshaped how people view location, with many moving due to the flexibility of remote work. This shift is mirrored in the digital world, where prime locations within metaverses — particularly in busy downtown areas — are more valuable.

Similar to real-world real estate, digital properties in high-traffic areas of the metaverse tend to be priced higher. Developers are increasingly focusing on the architecture and vibe of different sections of these virtual spaces, as content-rich areas attract more users and, in turn, increase property value.

By following these trends, you can better understand how to invest in digital real estate and make informed decisions in this space.

How to Build Your Own Digital Real Estate Website?

Building your own digital real estate website requires careful planning, the right tools, and a user-centric approach to ensure a seamless property browsing experience. Here’s a step-by-step guide to help you create a successful platform:

1. Define Your Website’s Purpose and Audience

Start by identifying the goals of your real estate website. Are you targeting buyers, sellers, or renters? Determine the specific services you’ll offer, such as property listings, virtual tours, or real estate consultations. Understanding your audience will guide the website’s structure and content.

2. Choose a Domain Name and Hosting Provider

Choose a domain name that is memorable and accurately represents your business. Secure reliable hosting to ensure your website performs well and loads quickly, especially when featuring high-resolution property images or videos. Hosting providers like Bluehost, SiteGround, or GoDaddy are popular options.

3. Select a Real Estate Website Builder or CMS

Select a content management system (CMS) or website builder based on your needs. Popular platforms like WordPress, Wix, or Squarespace offer real estate themes and plugins for easy customization. If you need advanced features, consider a custom-built website using platforms like Laravel or Django, or enterprise-level CMS solutions such as Drupal, Sitecore, or Adobe Experience Manager. Many businesses also rely on specialized services like Drupal Development Services, custom API integrations, or headless CMS implementations to meet their complex real estate platform needs.

4. Design a User-Friendly Interface

Your website’s design should be intuitive, visually appealing, and responsive across devices. Include essential features such as property search filters (location, price, size), high-quality images, and virtual tours. Ensure easy navigation for users to find property listings or agents quickly.

5. Integrate MLS and Property Listing Features

Integrating a Multiple Listing Service (MLS) allows your website to automatically pull and display property data from real estate databases. This feature saves time and keeps your listings updated. You can also provide the option for sellers and agents to post their own property listings.

6. Implement Essential Features

To stand out in the competitive real estate market, implement key features such as:

- Advanced Search Filters: Help users refine their search based on budget, location, property type, etc.

- Interactive Maps: Allow users to explore neighborhoods and view properties based on location.

- Virtual Tours and High-Quality Media: Offer immersive experiences for buyers to view properties remotely.

- Agent Profiles and Contact Forms: Enable easy communication between buyers, sellers, and agents.

7. Optimize for SEO

Optimize your website for search engines by using relevant keywords, creating high-quality content, and ensuring fast loading times. Real estate websites should include local SEO strategies, such as targeting specific locations (e.g., “Homes for Sale in [City Name]”), to attract local traffic.

8. Integrate Payment and Booking Systems

If your website includes rental properties, integrate a secure payment gateway for deposits and bookings. Additionally, you can provide scheduling options for home tours or agent consultations.

9. Test and Launch

Before launching, thoroughly test your website to ensure all functionalities work smoothly. Test the site’s responsiveness on different devices and browsers, and make sure the search and filter features are accurate. Once testing is complete, launch your digital real estate website and start promoting it through online marketing strategies.

By following these steps, you can build a powerful digital real estate platform that caters to buyers, sellers, and renters, offering them an efficient and user-friendly way to navigate the real estate market.

Implications of Real-Life Real Estate

Why should a real-life real estate investor care about digital real estate?

There are several compelling reasons. First, as the world shifts toward remote work and increasingly relies on digital assets for everyday tasks, the future is becoming more digital, and real estate is no exception to this trend.

As people become more engaged with metaverses, investing in digital real estate offers a promising opportunity to diversify your portfolio. While some digital properties come with high price tags, there are many affordable entry points. By timing your investment wisely, you could significantly increase your return on investment when selling at peak value. Additionally, as the digital metaverse becomes more integrated into daily life, the line between virtual and real worlds continues to blur. The items people purchase in metaverses often mirror those they acquire in real life. This gives digital real estate investors valuable insights into emerging trends, which they can apply to physical real estate investments.

Finally, the cost of digital land is now comparable to real-world property. For instance, Republic Realm, a virtual real estate company, recently sold virtual islands for $300,000 each.

7 Ways to Make Money from Digital Real Estate

There are various ways to profit from digital real estate, including registering domain names, hosting, and offering advertising space to businesses. Let’s explore 7 specific methods in more detail.

1. Advertising

Businesses that own digital real estate can earn money by selling advertising space on their websites or other digital platforms, even metaverse-based billboards. This includes displaying banners, pop-ups, videos, or sponsored content on high-traffic online platforms.

2. eCommerce

Companies can enable customers to purchase goods and services directly through their digital properties, such as websites, online marketplaces, or mobile apps. These platforms also provide valuable insights into consumer preferences and behaviors, which can help improve marketing strategies and product offerings.

3. Subscription Services

Organizations can offer exclusive content or additional services for a recurring fee, generating steady revenue. When customers find value in the subscription, they are more likely to stay loyal, boosting long-term customer retention.

4. Domain Name Registration and Hosting

Businesses can offer domain name registration and hosting services, providing clients with an affordable way to establish their online presence. Additionally, buying and selling premium domain names can be profitable, generating recurring revenue for the business.

5. Bringing Real Estate to the Digital World

Companies can create digital twins—virtual representations of physical properties—or provide these services to other real estate businesses. Virtual tours using digital twins give potential buyers a clear understanding of a property, aiding in the decision-making process. Additionally, placing properties in the metaverse or developing a proprietary metaverse platform allows businesses to expand their real estate into the digital world.

6. Real Estate Tokenization

Real estate tokenization development companies can convert ownership of physical assets into digital tokens that are traded on real estate tokenization platforms. Tokenization enables fractional ownership, making real estate investments more accessible and affordable. It also increases liquidity, enhances transparency, and reduces costs associated with traditional transactions by eliminating multiple intermediaries.

7. Buying and Selling Property-Backed NFTs

Businesses can buy and sell NFTs linked to real estate, both in and outside the metaverse. These NFTs represent unique, scarce digital assets tied to real-world properties. Since NFTs are stored on the blockchain, the buying and selling process is decentralized, ensuring security and transparency. Companies purchase NFT real estate for various reasons, including potential appreciation and brand promotion, allowing them to interact with their target audience in digital spaces through NFT marketplace platforms.

It’s important to remember that making money in digital real estate requires a significant investment of time, effort, and resources. Success is not guaranteed, and businesses should understand the risks before diving in, and seeking professional advice as needed.

How SoluLab Can Help in Digital Real Estate?

SoluLab, as a leading real estate tokenization development company, offers comprehensive solutions to help businesses enter the digital real estate market. Whether you’re looking to tokenize physical assets, create digital twins, or develop real estate-backed NFTs, our expert team can provide you with the technology and tools needed to succeed. We specialize in creating secure real estate tokenization platforms, enabling fractional ownership and increasing liquidity in real estate markets. With our deep understanding of blockchain platforms, virtual reality, and the metaverse, we can guide your business toward maximizing returns in this evolving space.

We recently launched a project named NFTY, a protocol developed to promote quality in NFT marketplaces by creating a reputation layer for NFT transactions. Using the NFTY token and a USD-backed stablecoin, the protocol rewards creators and advocates based on their contributions, ensuring transparency and trust. SoluLab built the NFTY protocol with features like time staking, chain agnosticism, digital scarcity, and smart contracts, providing a robust foundation for evaluating and promoting digital assets. This innovative solution aims to bridge various NFT ledgers, enhancing the overall credibility of NFT exchanges.

Partnering with SoluLab means leveraging the latest advancements in digital real estate technology. Our customized solutions ensure that you stay competitive, whether you’re selling virtual properties, offering digital land for advertising, or creating new revenue streams through metaverse-based real estate. Ready to transform your real estate business? Contact us today and take the first step toward unlocking the potential of digital real estate.

FAQs

1. What is digital real estate?

Digital real estate refers to virtual properties like websites, domain names, or spaces in online worlds that can be bought, sold, or rented. It’s similar to owning physical property, but it exists in the digital space.

2. How does digital real estate differ from traditional real estate?

While traditional real estate involves physical properties like houses, land, or commercial spaces, digital real estate is entirely virtual. It includes assets such as domain names, websites, and land within virtual worlds. The key difference is that digital real estate exists online and is not subject to geographical limitations, but it can still be bought, sold, and rented like physical property.

3. How can I invest in digital real estate?

To invest in digital real estate, you can purchase domain names, websites, or virtual land in metaverse platforms. You can also create digital properties like e-commerce sites, or participate in real estate tokenization platforms, where physical assets are tokenized and traded as digital assets on blockchain networks. Researching potential growth opportunities is crucial for maximizing returns on digital real estate investments.

4. What advantages come with making an investment in digital real estate?

Digital real estate offers several advantages, including lower barriers to entry compared to traditional real estate, the potential for higher returns, and the flexibility of operating in a global market. Additionally, with the growth of the metaverse and blockchain technologies, there are emerging opportunities to diversify portfolios and tap into new revenue streams.

5. Is digital real estate a good long-term investment?

Digital real estate has strong potential as a long-term investment, particularly with the increasing adoption of blockchain and the metaverse. However, like any investment, it comes with risks, including market volatility and technological challenges. Proper research, understanding market trends, and selecting high-potential digital properties can significantly improve long-term outcomes.